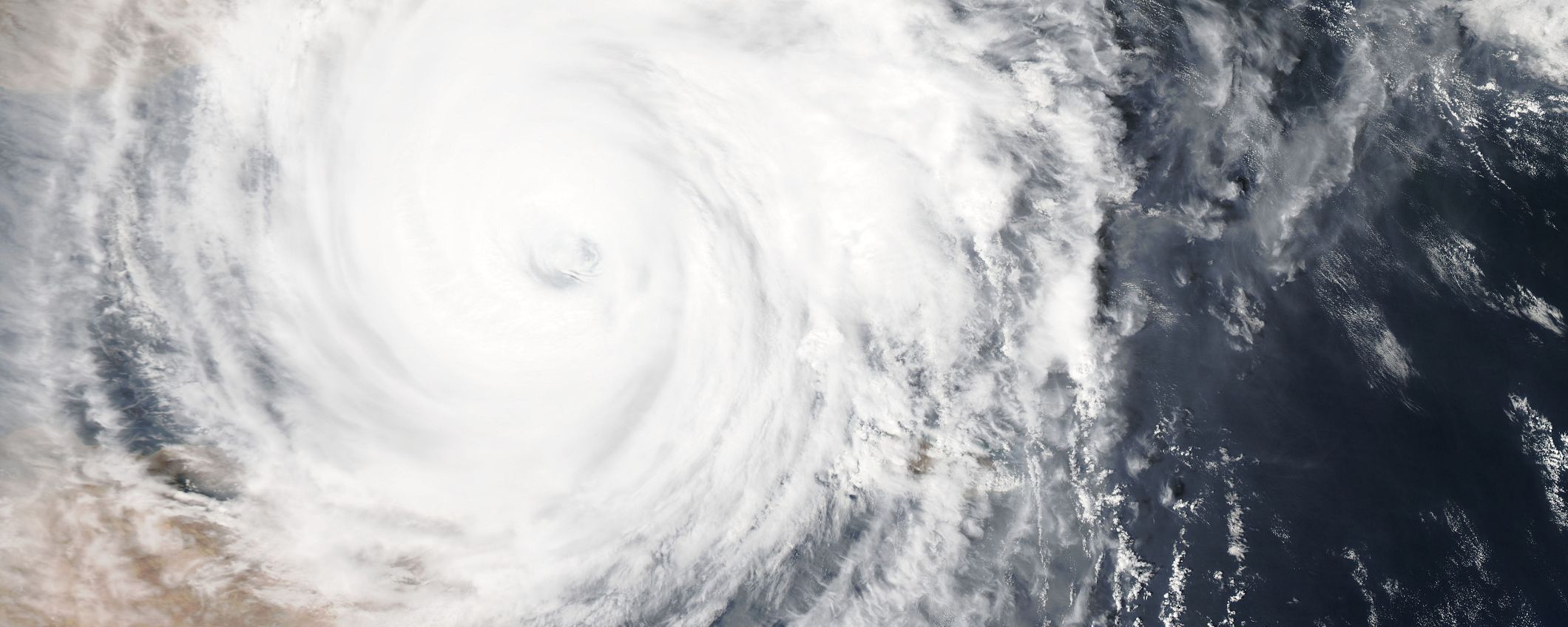

Are we in the eye of the hurricane or is the economic bad weather no more than a shadow of the past? Or worse: do our economic activities increase the severity of new hurricanes, both economically and in real life?

Synchronized firming

There are two words that can be found in almost every comment on the current macroeconomic situation: synchronized and firming. The business cycles across the world are more synchronized than ever before. The length of the upturn in the US is almost unprecedented with 32 quarters since the last recession, even though the record of 46 consecutive quarters without a recession is still four years off. In sync with the US, the Eurozone has finally reached the stage of broad-based recovery with a growth of around 2%. And countries that contributed negatively to global economic growth, such as Russia and Brazil, are now also recovering. The firming of the global economy is that this synchronization leads to upward surprises. Global growth is reaching its highest pace since 2011 with an expected average growth of 3.8% in both 2017 and 2018. The firming of the economy is reflected in on average lower unemployment rates, higher consumption and investments, and an increase in world trade and production. The same is true for asset prices. Equity prices are still rallying, reaching new records. House prices are also on the rise in most economies, albeit giving reason to start worrying about asset price bubbles.

Political storms without casualties

One of the biggest positive surprises this year is that political events – varying from elections in various European countries and the wayward character of the Trump administration to the Brexit negotiations and the political tensions between North Korea and the US – have so far had no negative consequences for the global economy. It seems that in the current environment positive developments from a macroeconomic perspective, such as Macron’s victory in the French presidential elections, seem to outweigh the possibly negative news, such as the slow progress in the Brexit negotiations. And although the upcoming German elections and the ongoing challenging circumstances for the Trump administration to get its agenda through Congress may lead to increased political uncertainty, there seems to be no reason to expect too many negative effects on the world economy.

In the eye of the hurricane?

One of the biggest challenges that macroeconomic policymakers currently face is how to use this economic momentum to normalise monetary policy. But all is quiet on that front. Every major central bank has its own issues to worry about and reasons enough not to speed up normalisation: in the US it is a combination of low inflation and moderate wage increases combined with an uncertain political environment. In the UK it’s Brexit, Japan still faces the same issue it has been facing for the last twenty years – deflation - and the ECB worries about the absence of wage pressure and the risk of a higher exchange rate vis-à-vis the dollar once it gives a clearer leeway of monetary tightening.

Fiscal policy is suffering the same directionless considerations in almost every country. On the one hand, fiscal tightening seems the right course given the high public debt levels. On the other hand, fiscal loosening seems in order to stimulate demand and thus solve or at least ease the problems of central banks. This is also the stance of the IMF.

In short, the current state of contemplation will likely continue. If they do not seize the moment of a benign macroeconomic environment, when and how are central banks then going to shrink their balance sheet and increase interest rates? And how will fiscal policy ever get more effective and government debt in control if interest rates rise?

We are not going to wait, are we?

When you have gone through a hurricane and start rebuilding again, you take care of the damage you have suffered and take measures to better withstand the next storm. Economic policy makers, on the other hand, seem to be a more optimistic breed. After the latest economic crisis, they took to rebuilding the economy according to the usual approved recipe: credit- and material-intensive growth. Given the lack of precautionary measures, this ‘more-of-the-same’ policy will lay the ground for the next crisis. There is no clear way out of the current monetary policy and no clear direction for fiscal policy.

Going back to the weather metaphor, there is ample evidence that the severity of the hurricanes is related to global warming. Climate change will lead to more extreme weather in the coming years, even if we would immediately stop emitting greenhouse gases. Could it be more obvious? Policy makers should make the economy more sustainable. Now is the time to rebuild our economy in such a way as to make it more resilient to the next economic storm, instead of continuing on the same road that leads to increasingly severe new hurricanes. Here is my short wish-list for policy makers:

Use fiscal space for the transition to a sustainable economy: renewable energy, sustainable infrastructure, long-term policy guidance;

Normalise monetary policy: the timing will not get any better in the short term;

Use monetary policy to make the economy more resilient: investments in infrastructure, renewable energy et cetera;

Set standards for investments in sustainable initiatives like green bonds: stimulate the private sector to step in.

If we do not succeed in devising a more proactive policy, we will be caught by surprise when we are no longer in the eye of the hurricane. There is no need for that. So let’s act.