Hans Stegeman, Head of Research and Investment Strategy, explains the essence of Triodos Investment Management’s approach to solving these difficult-to-navigate challenges, through investments in listed equities and bonds.

We need radical transformation

Over the last few years a series of highly ambitious goals have made their way into the public eye. The Paris Climate agreement was a landmark achievement, and the introduction of the UN Sustainable Development Goals gave world leaders a roadmap for a more sustainable society.

To be successful in achieving these goals we must embrace radical transformation. Our system can no longer exclusively pursue economic expansion and financial return. We must transition towards a sustainable system that respects our planet’s ecological balance and works for the benefit of all.

All we need is courage and capital. The courage to make radical choices, and the capital to mobilise them – financial capital, human capital, intellectual capital, natural capital, social and manufactured capital. We cannot be content with merely reducing the collateral damage of our current model. Instead, we must build a regenerative system that paves the way for a sustainable, circular and inclusive society.

Our impact equity and bond funds go beyond conventional ESG-approaches to invest for positive change.

More than ESG and exclusion focused funds

Company sustainability ratings and exclusion approaches have been instrumental in facilitating swift market adoption of ‘do no harm’ and environmental, social and governance (ESG) portfolio optimisation. With ESG we are moving in the right direction but few realise that these approaches are ineffective at actually steering capital toward companies that bring sustainable solutions into the marketplace.

We need to quicken our pace. It is not enough to invest in best-in-class companies which, within their sector, belong to the least polluting. For a truly sustainable future, we must invest in companies that actively contribute to a healthy planet and inclusive societies.

ESG and exclusion focused funds, which make up the overwhelming majority of the market’s ‘sustainable investment’ options, eliminate companies from an index using quantitative ESG thresholds, sector-wide screens, or norm-based exclusions to be left with ‘no harm done’ or ‘best-in-class’ portfolios. This means that at no point during the investment process is a company’s positive contribution to society is considered.

What is our role as impact investor?

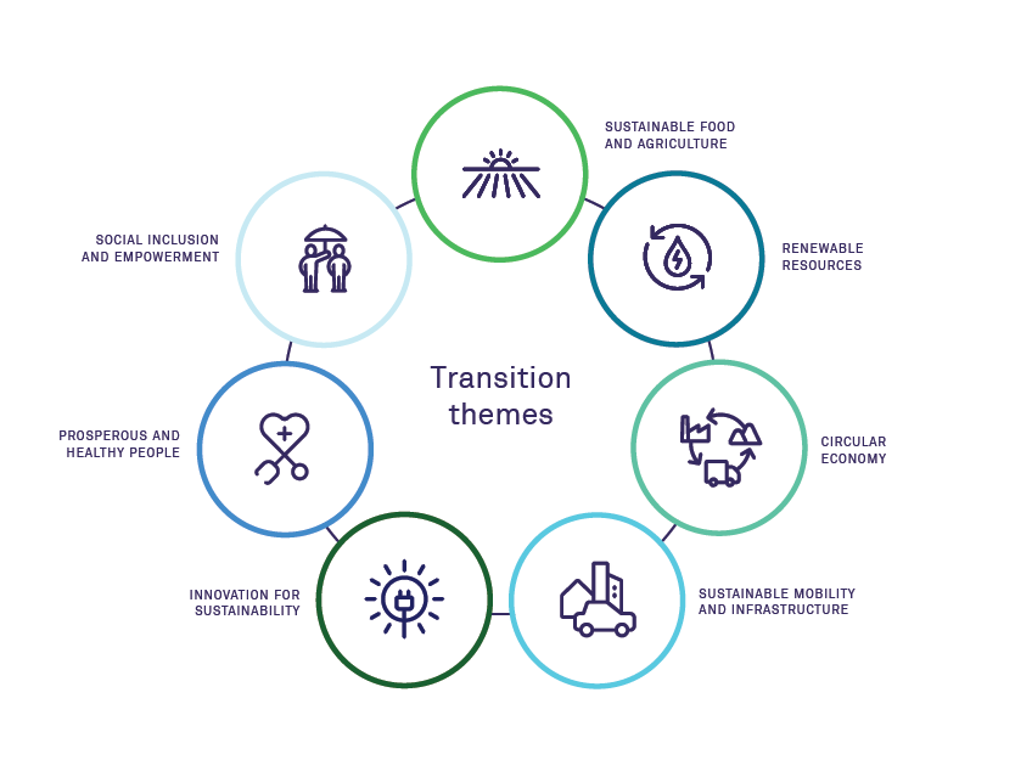

Triodos IM's impact equity and bond funds go beyond these conventional approaches to invest for positive change. We have defined seven themes that are instrumental in the transition to a sustainable future, and that guide our portfolio construction. Our company selection focuses first and foremost on including the real innovators and drivers of sustainability.

Triodos IM follows an inclusionary, bottom-up, investment process that puts positive impact at the center of stock and bond selection. Every investment in our portfolio must materially contribute to at least one transition theme through its products, services, and/or business operating models. To be eligible for investment, companies also must meet our industry leading process, product and precautionary minimum standards.

Once companies are deemed eligible for investment from a positive impact and sustainability perspective, we then evaluate the company’s financial value drivers, and assess the potential impact of internal and external sustainability factors on future profit and loss.

How our impact strategy aligns with the SDGs?

There are natural links between the SDGs and our transition themes. They address the same topics that are key to achieving the underlying SDG targets and indicators. While the SDGs primarily help governments set policy priorities up through 2030, our transition themes aim to sustain positive development beyond this timeline and represent a holistic view of investable solutions.

Sustainable transition solutions can be very nuanced and technical and, yes, sometimes pose a dilemma. Our analysts and fund managers therefore thoroughly challenge companies and their products to ensure alignment with our core vision on sustainability. Food scarcity, for example, is a major challenge, and there are various ways to consider solving this. One way could be by increasing crop yields through genetically modified organisms (GMO). Given the negative impact of GMO on biodiversity, however, our answer would be to reduce food waste, thus satisfying a substantial part of the demand without requiring additional input.

Triodos IM believes that it takes courage and capital to achieve a sustainable future. Join us in this transformation.

We invite you to learn more, download our whitepaper "Impact investing through listed equities and bonds".