Impact investing through public equities is a new frontier. The report ‘How to maximise impact when investing in public equities' aims to empower investors and demystify the various shades of green they are likely to encounter when reviewing equity funds against their impact and financial goals.

Sustainable investing has earned its own glossary of terms and acronyms, and ranges from very light, to intentional, deep impact.

Core part of a diversified impact portfolio

Public or listed equities are often the core part of a diversified investment portfolio. Research shows that investors, on average, allocate 20 to 40% of their total portfolio to equities, and this percentage is even higher for the younger generation of impact investors who can afford slightly higher risk-return profiles. The majority of them choose to invest in public equities through professionally managed fund structures such as UCITS.

How do sustainable equity funds select investments?

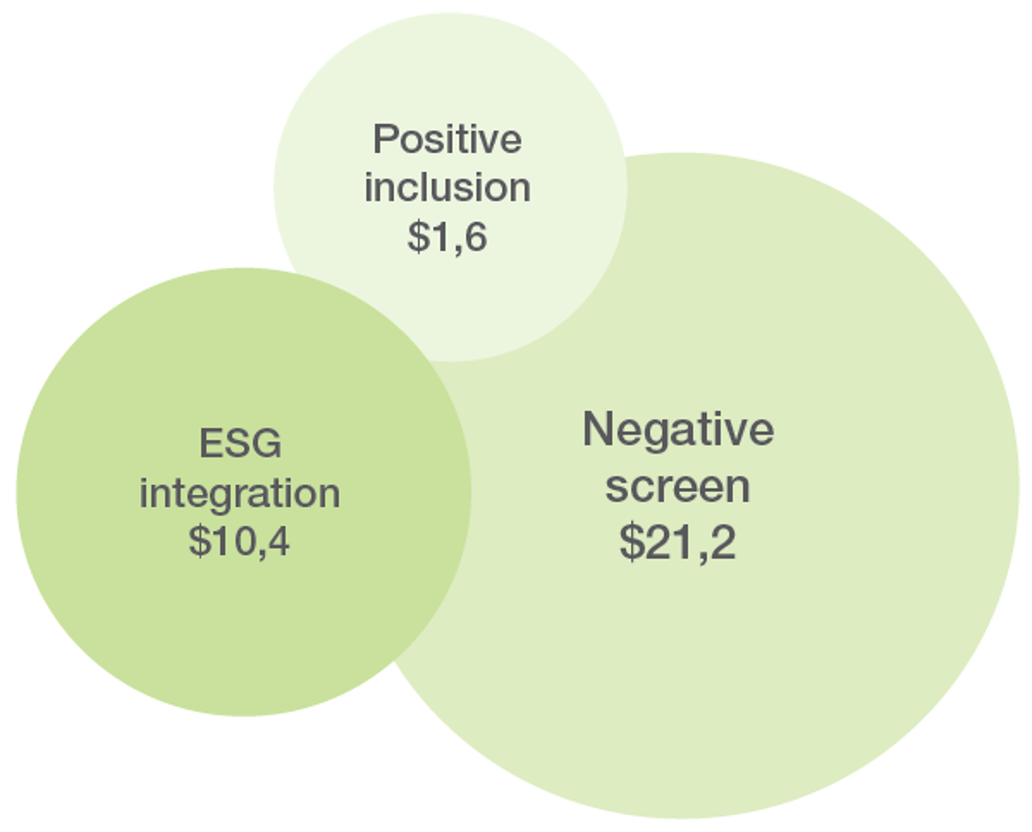

Each fund manager applies different guidelines when selecting companies for their sustainable investment portfolios. Roughly speaking, there are three general methodologies that serve as the basis for most selection processes:

> ESG risk-return optimisation,

> negative screening or exclusions, and

> positive inclusion.

As seen in the image above, negative screening currently is, by far, the most widely adopted strategy in the sustainable investment space - followed by ESG integration and positive inclusion, respectively. However, investors are quickly increasing their allocations to these positive inclusionary, often thematic, approaches.

An open dialogue when choosing a fund or wealth manager

When selecting a manager to build and maintain your impact investment portfolio, the report recommends initiating an open dialogue to understand if the manager's vision for sustainability aligns with your own. You should also determine if their investment process is suitable to facilitate your desired impact, as, often, negative screens or ESG integration, alone, are not sufficient to steer capital toward the most impactful companies.

The Triodos IM approach to impact investing through listed equities

As an impact investor, we put positive impact at the core of all of our investment decisions. While most funds apply just one of these above strategies, our impact equity funds layer in all three approaches to maximise our impact, starting with positive inclusion:

- Anchored in sustainable solutions, we, first and foremost, positively include companies that contribute to solving sustainability challenges through their products and services.

- Then, after hand-selecting companies with the most impactful products, we continue our analysis to ensure they meet our minimum standards, which have proven to be some of the strictest in the industry.

- Lastly, our investment team conducts an integrated analysis on the companies, focusing on the potential impact of internal and external sustainability factors on a company's future financial value.

Throughout all stages in the investment process, Triodos IM is an active investor and steward of the planet. We actively engage in dialogue with companies to positively influence sustainability performance across their business models and supply chains. It is our policy to vote at the shareholder meetings of all companies in which we are invested.

Read more about how Triodos IM invests for impact through listed equities.

Download the report ‘How to maximise impact when investing in public equities'