An issue that remains underexposed, is that this large-scale intervention constitutes an even greater bailout of companies that, prior to the coronacrisis, made a lot of profit but did little to reinforce their balance sheets. By these companies I mean, first and foremost, large international enterprises and not so much smaller and medium-sized companies or the self-employed. When things go well, the upside is for the company itself and is not shared. But if things go wrong, the government is expected to step in, and the downside is ultimately to be borne by society at large. It is time we changed that. Governments should make support conditional on requirements such as companies making their products or production methods more sustainable. But they should also get a share of the profit once things go well again, for instance by requiring these companies to at least start paying taxes again at the normal rate. One good turn deserves another.

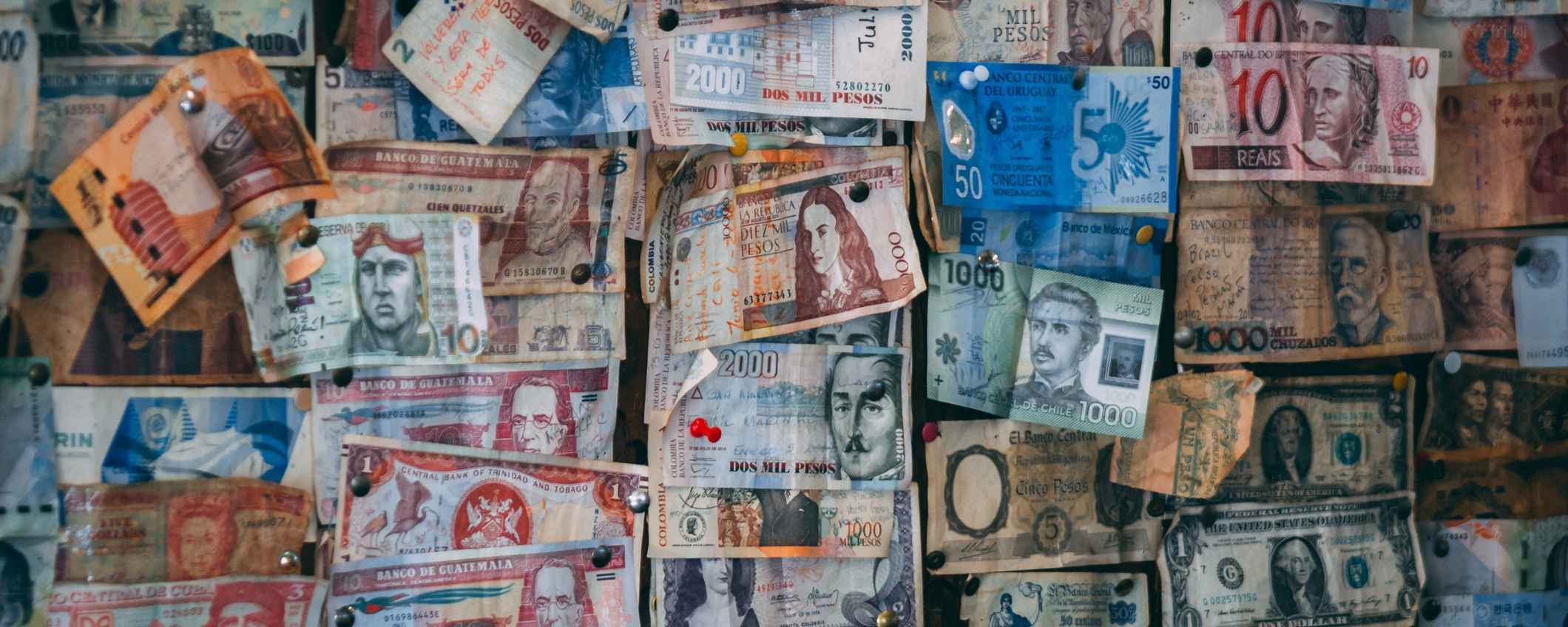

About money and solidarity

The billions of euros that central bankers and governments inject into the economy and society rarely make the news. The news is, understandably, dominated by our acute healthcare problems and measures to combat the spread of the virus.

This was very different during the financial crisis of 2008. At that time, the Dutch cabinet’s press conferences only focused on the billions of euros in government support that were being provided. Banks that had to be bailed out by governments became the object of anger and derision from average citizens. The bankers had used the huge profits that they had made during the years of prosperity mainly for paying themselves big bonuses and for handing out high dividends to shareholders. When it went wrong, it turned out their buffers were virtually non-existent, and the taxpayer paid the price. Because, allegedly, the financial system was ‘too big to fail’. In return for their support, governments were given some control whilst they had a financial finger in the pie. Around a decade later, ‘we’ still partly or wholly own several financial institutions.

The same thing happened during the euro crisis, which was only about money and solidarity - or in fact the lack thereof. And because the European leaders could not agree, the European Central Bank had to take unprecedented measures (“whatever it takes”) to restore calm to the financial markets.

Different cause, same effect

The coronacrisis has a very different cause. The current crisis is not due to problems within the financial system, but to a worldwide health crisis. However, this health crisis goes hand in hand with a huge economic crisis. Although the exact scale of it is yet unknown, we can assume that it will far exceed that of the financial crisis, given the latest projections of international organisations. It therefore makes sense that policymakers are doing everything they can to mitigate the economic damage by means of massive intervention. Central banks, led by the US Federal Reserve (Fed), have therefore steadily expanded their arsenal of unconventional measures. The latest step, taken last week, was for the Fed to start buying risky bonds. 'Fallen angels', i.e. corporate bonds that have been downgraded by rating agencies, can now count on the central bank’s safety net. So once again, risks are borne by the community.

And that also means that this crisis, and therefore government policy, is just as much about money and solidarity as was the financial crisis. Except this time much larger amounts of money are involved.

If we do decide to lend listed companies a helping hand, our society should get something in return.

Vested interests

None of the vested interests are of course served by falling share prices or lower oil prices. But if the earnings outlook for companies is downgraded substantially as a result of the current crisis, this should also be reflected in share prices. The same goes for the oil price: if demand falls sharply due to lower economic activity, a lower oil price is the logical outcome.

It appears that this cannot be allowed to happen. In order to shore up the oil price and keep the oil sector afloat, a larger cartel deal has been concluded than ever before in history - at the expense of sustainability. Prices of stocks as well as bonds are currently being supported even more heavily than in 2008 by central banks’ purchase programmes. This really comes down to a bailout of listed big enterprise companies: in the past decade the average remuneration of CEOs worldwide rose sharply. The main redeeming element was that companies maximised short-term shareholder value by optimising balance sheets, buying back shares and avoiding taxes. They made very few or no provisions for a rainy day and it was left to the community to deal with the negative impact of business operations, such as greenhouse gas emissions. As a result, the economic headwinds that have now picked up are hitting us even harder.

I may be exaggerating slightly, but I call this socialism for the rich in capitalism for the poor. Because big enterprise is rescued when things go wrong, while large numbers of ordinary workers are now joining the unemployed. And in addition, with some delay, they are also paying for the bailout of big enterprise through their tax payments.

Control and transition

Most people are currently preoccupied by the acute impact of the crisis: on their health, their income, their children being forced to stay at home. Let’s hope that these restrictions will be lifted at some point. But we need to look further ahead. All around the world a great deal of public money is currently being used to serve the vested interests, via the balance sheets of central banks and government budgets. However, these vested interests are often not synchronised with the interests of our societies. Why should central banks be buying bonds issued by oil companies? Why should governments unconditionally bail out listed companies that run into problems due to weak balance sheets?

And if we do decide to lend listed companies a helping hand, our society should get something in return. There are at least two ways of achieving this. First, we can set conditions for the social contributions to be made by companies. Demanding, for instance, that they reduce their negative impact, such as CO2 emissions, but also that they make a much bigger contribution to the sustainable development goals that we as a society want to achieve. Second, as also happened with banks, control could be claimed in companies that receive support. That means having a say in setting their strategies, but also, as a society, benefit when things start to pick up again. So that in future society will also benefit from the upside and will not only pay for the downside.

This is a translation of an article published earlier in Dutch newspaper NRC.

For more related news, views, insights, and economic outlooks regarding COVID-19 and the economic crisis, visit the COVID-19 page on our website.