We define ‘material’ as the impact on a broad set of stakeholders, including the company itself, its owners and employees, clients, suppliers along the value chain, plus society and the environment. This is in line with the six capitals as defined by the IIRC’s <IR> framework.

We want sustainability data that represents the effects of the company’s business model and operations on these various capital stocks. As asset managers that take active positions in companies based on impact, we are eager to see non-financial information that helps us understand the material sustainability effects of a company’s business model and operations. We call on the European Commission to clarify and strengthen company reporting obligations so that material non-financial information becomes widely available for investors and that companies are held to account.

Non-Financial Reporting Directive (NFRD)

Since 2018, large publicly listed companies have been required to include a non-financial statement as part of their annual filings as part of the EU’s Non-Financial Reporting Directive (NFRD). The NFRD identifies four issues that need to be addressed: (1) environmental, (2) social and employee issues, (3) human rights and bribery, and (4) corruption. Companies are required to disclose information about their business model, policies, outcomes, risks and risk management and other KPIs that are relevant to the business.

Based on two reporting cycles, the Alliance for Corporate Transparency analysed the NFRD disclosures from one thousand European companies. The outcome was that these disclosures are consistently of poor quality. The analysis found that while general policies are readily available, companies lack reporting on targets, performance against these targets, and specific information on risks and impacts.

Too many reporting frameworks?

We often hear from companies that there are too many reporting frameworks out there to be able to see the trees from the forest, and that despite the fact that they increase their reporting of non-financial information, rating agencies, investors and other stakeholders keep asking for more information.

It is certainly true that there is an abundance of reporting frameworks (SASB, GRI, GIIN IRIS+, Future Fit, NFRD, just to name a few) and that this may be confusing for companies. It is also true that we see companies making an effort to publish more non-financial data. CSR reports seem to get longer every year. However, companies end up wasting a lot of their time and resources collecting and analysing data that only has minor (or no) impact on the overall sustainability or financial performance of their business.

Companies get away with reporting almost nothing

To give an example, the water consumed by a bank’s office space is not material for the sustainability profile of the company. Yet, this data is collected, analysed and reported by many financial institutions. On the other hand, the Alliance for Corporate Transparency found that only 13% of financial organisations provide details on their portfolio exposure to the most polluting sectors, such as financing to the oil and gas sector. The latter is, of course, far more relevant to determine the sustainability performance of a bank due to its greater real-world impact and representation of the bank’s on-the-ground business decision-making. When we ask for material data, we mean topics that have the biggest impact on society (including the company itself). Often these indicators will also signal potential financial impacts, but not per se.

As the current NFRD requirements are very general, companies get away with reporting almost nothing. We are convinced that companies know very well where their biggest positive and negative impacts lie and where they can make the most difference. So, why is it that most companies choose to report data that doesn’t reflect the significant impacts of the business? Is it a fear of losing competitive advantages or sharing business sensitive information? Is it inabilities to collect and analyse this data? Or perhaps a lack of clear indicators?

Five aspects to change, clarify and strengthen the NFRD

We can relate to all these concerns and challenges. Therefore, we call upon the European Commission to change, clarify and strengthen the NFRD on several aspects.

- There needs to be a clear level playing field, meaning that all companies need to report on a number of clearly defined baseline KPIs (such as science based climate targets, tax transparency and remuneration). On top of that, companies should report on sector specific KPIs. We support the SASB framework for sector specific indicators.

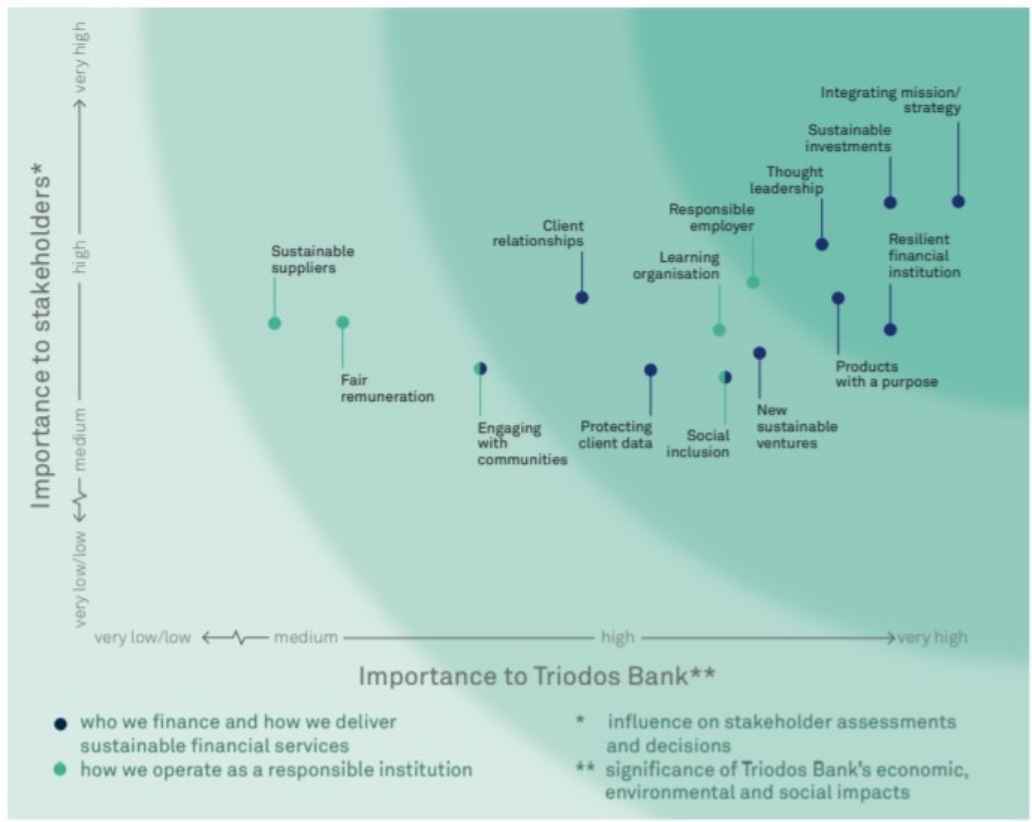

- Companies should be required to conduct a materiality assessment with its key stakeholders using a materiality matrix to define the most important non-financial KPIs. In developing the matrix, a wide range of stakeholders need to be consulted. Companies need to explain the steps taken to develop the matrix.

- Companies should report on the KPIs that were identified as most material in the matrix and that were not yet captured by the baseline or SASB indicator sets. They should also explain why they consider these additional indicators to be material including how the indicators are defined, assessed, and calculated, and any progress towards those KPIs.

- The non-financial data needs to be published in a clear, easy-to-find and comparable way. Preferably through a centralised open-source database.

- Finally, we want to encourage the European Commission to change the name of the NFRD to SRR (Sustainability Reporting Regulation). We think the term non-financial information is misleading because material sustainability information will likely at some point present meaningful financial implications on the company.

Materiality matrix 2019, Triodos Bank

There are many advantages to such an approach. Companies can streamline the number of indicators they report on, which saves them from needing to manage such large amounts of data. Having access to a uniform and comparable dataset for companies will help investors make informed investment decisions and providing a clear reporting standard for the KPIs will help accountants be able to provide deeper levels of assurance on the data.

Business-relevant and decision-useful small data

We call upon the European Commission to simplify, clarify and strengthen reporting obligations, so that non-financial reporting includes what matters most both for the company and its stakeholders. We hope these changes will take non-financial reporting down from big data to business-relevant and decision-useful small data.

The European Commission made a commitment to review the directive by the end of 2020 and recently launched a consultation for the process leading up to the revision. We are grateful for the opportunity to provide input on this important consultation and, although not yet final, we expect our formal feedback to the Commission to be in line with the content of this article.

Visit the fund pages on our website for more information about our Impact Equities and Bond funds.