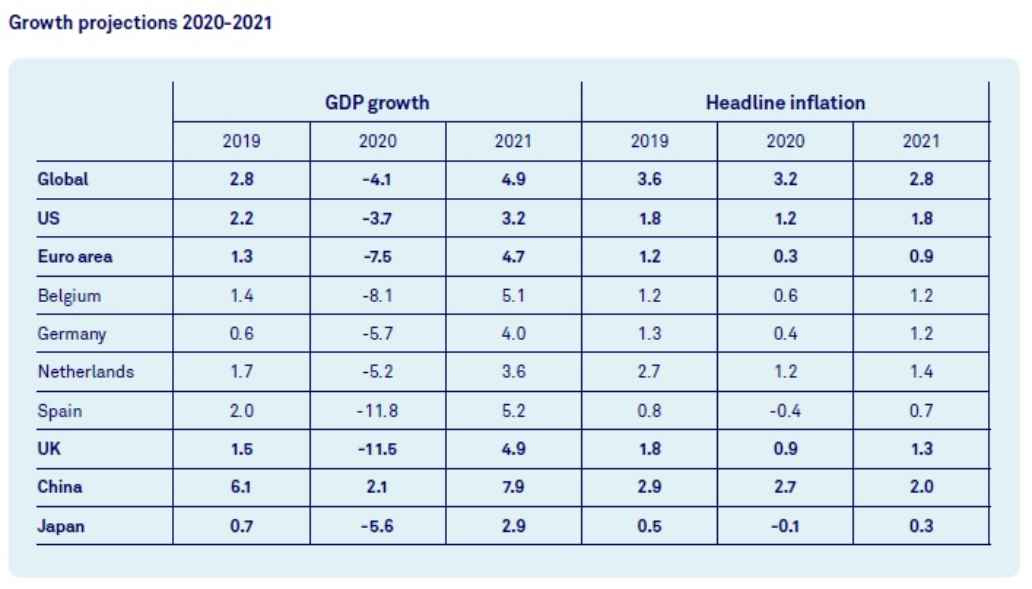

In developed markets the recovery will likely be slow amid recurring restrictive measures. For 2021, we expect global economic activity to rebound by 5.0% and developed economies to grow by an aggregated 3.7%. Pre-pandemic economic activity levels can only be reached once a vaccine has become widely available. Despite positive vaccine developments, we don’t expect this to happen before the second half of 2021. In the meantime, further stimulus is expected. Bold policy choices need to be made for the recovery to become sustainable and inclusive. This could be a vital first step towards a new economic system, one that is equipped to address the challenges of our time: climate change, biodiversity loss and inequality.

Investment outlook

Across the world, financial markets experienced a spectacular recovery after the COVID-19-induced freefall. This recovery was driven by unprecedented monetary and fiscal stimulus. As a result, the financial asset bubble became rapidly inflated again. We are still convinced that valuations matter, and that the real economy and financial markets can’t stay detached forever. We do however acknowledge that there is plenty of stimulus in the pipeline to satisfy short-term investor appetite. But against the backdrop of record high global debt levels and overly optimistic economic and earnings projections, we stick to our fundamental approach and do not chase the rally. Therefore, we remain cautious in our asset allocation, neutral on average in bonds and slightly underweight in equities. Within equities, US equities are still expensive versus other markets, which is why we remain negative about US equities, neutral to slightly positive about European equities and positive on Japanese equities.

We continue to see opportunities in the sustainable investment landscape, especially in Europe and Japan. The European Green Deal, the EU’s roadmap for making its economy sustainable, will likely gain momentum. The related development of a green taxonomy will enable investors to steer their investments towards more sustainable technologies and businesses, and the creation of an EU Green Bond Standard will deliver a uniform tool to assess green bonds. We hope that this will trigger an increased global sense of urgency that catalyses investments in climate change mitigation and adaption and contributes to the fulfilment of the Sustainable Development Goals within the next 10 years.

Uncertain recovery

Read the full Developed Markets Investment Outlook 2021.