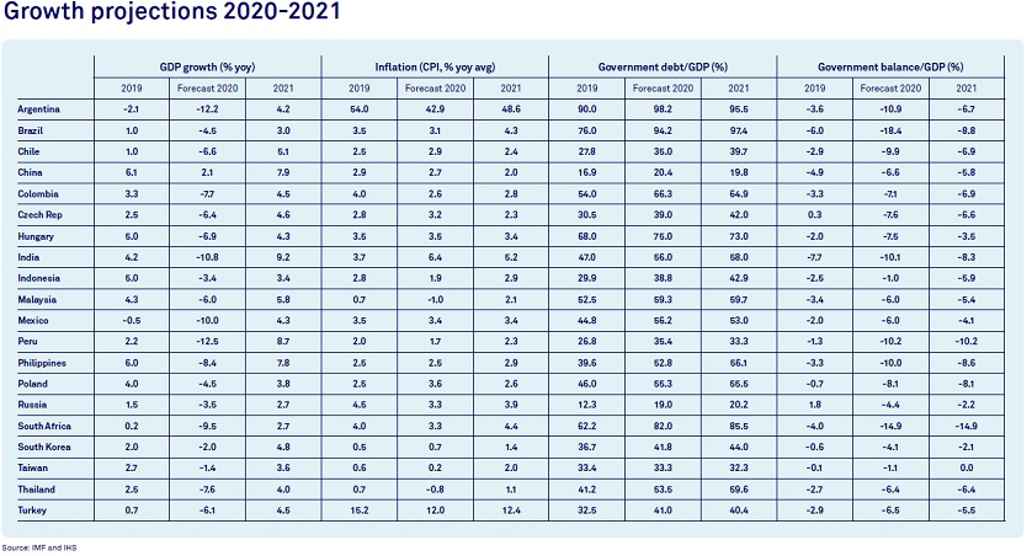

Our emerging and developing market outlook for 2021 is one of a cautious and uneven recovery, with risks tilted to the downside. After almost a year of global crises – both health and economic - and unprecedented stimulus, support will be nearing an end for most countries. The availability of the vaccine is spreading optimism worldwide. And there is one swing factor that could help some emerging countries to offset the impact of the pandemic to some extent in the coming year: China’s recovery. As the second largest economy in the world, China is positioned as a fundamental player in terms of commodity demand, a foreign credit provider and a high value-added producer in the technology race. Countries are expected to be lifted by increasing trade flows and access to capital markets. However, low-income countries with large funding gaps, will rely on debt relief and concessional financing to be able to take part in the economic recovery.

Near-term outlook

Our baseline projections for emerging and developing markets assume that the worst of the crisis is over in terms of economic contraction, with the largest impact having taken place in the first half of 2020. However, the coronavirus pandemic will not end abruptly. It is likely to fade away slowly, and this process may go on beyond 2021. Our assumption is that an effective COVID-19 vaccine will be available to the public in the first half of 2021, but it will take longer for some emerging markets to get hold of it.

Long-term outlook

Severe economic contractions like this one will undoubtedly cast long-term effects on potential growth and income inequality. The loss of human capital, reduced investment and slower adoption of new technologies means that countries will not be able to grow at their full potential. At the same time, given that poorer countries and the most vulnerable workers within a country were the hardest hit, this will

exacerbate inequality now and in the future, if the right actions are not taken.

As impact investors, we will have to do more, by allocating capital for change (see our vison paper Investing in Radical Change).

Riding China's recovery wave

Read the full Emerging Markets Investment Outlook 2021.