The pandemic has unexpectedly accelerated certain trends in financial inclusion. Government interventions to reduce mobile costs and the rollout of cash transfers to mitigate the impact of the pandemic have led large segments of the population to open bank accounts and use digital wallets. Only in Latin America more than 40 million people have opened accounts since the second half of 2020 according to Americas Market Intelligence. In the Philippines, shortly after the pandemic four million digital bank accounts were opened.

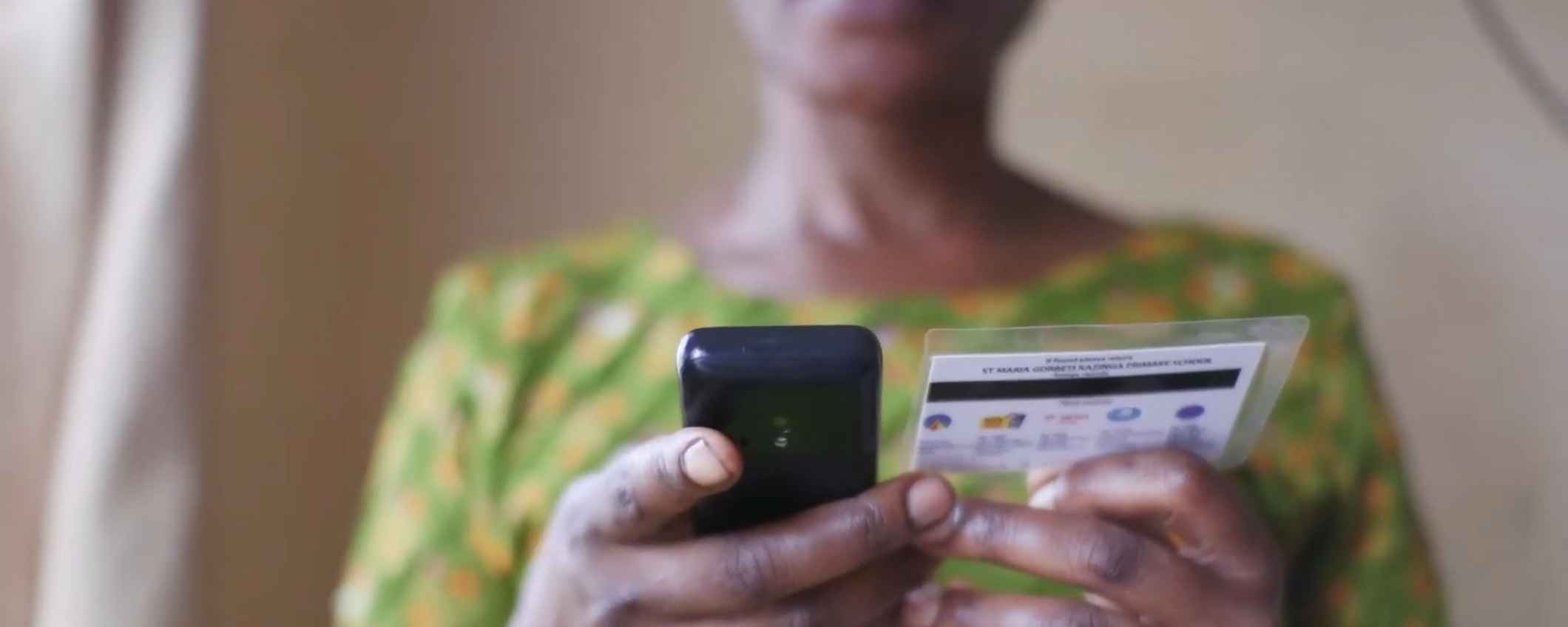

So far, anecdotal evidence suggests that women from low-income families have by far been the strongest beneficiaries of cash transfers. This is consistent with research on emergency cash transfers that conclude that women, as caregivers in households, are often the recipients. Millions of women are now the owners of a bank account. But financing change is more than just accessing traditional or digital banking. It implies identifying the customer’s specific needs and preferences and blending these to generate the most impact for clients and society, while looking at ways to make financial systems strong. It’s also about providing a long-term service that allows planning, saving and borrowing.

Bringing in more women to the financial system is releasing a large potential: the female economy is large, fast growing and with considerable positive spillovers for society. The Fintech industry, which uses digital technologies to transform financial services, is moving at a fast pace to capture this niche. Gender specific data, created through intelligent approaches, point out that servicing women provides if not the same even higher usage rates than when servicing men, women are more disciplined in payments, while the costs for onboarding them are lower. Gender-tailored platforms, that are specialising in delivering financial products and trainings that work for women, are proving to be successful business models in taking women a step forward in their entrepreneurial aspirations, which in many cases have a broad and measurable impact for society.

Bringing in more women to the financial system is releasing a large potential.

To make the most of financial inclusion in today’s recovery efforts, we need to ask the right questions. How do women want to be onboarded when new financial services are provided? Is the repayment behaviour different for women? Do financial products need to be adjusted to lower financial literacy levels? How sensitive are women to the costs of financial services? Surveys and research point to large differences when approaching these and other topics with a gender lens. For instance, women are more willing to use fintech services when they consider it cheap, are disciplined savers and report on average to have lower levels of financial literacy than men. We need to take these differences into account. Women are no longer on the sidelines; they are ready to make financial inclusion a more permanent part of their lives.

This column was inspired by the panel discussion on Gender Lens Investing in Financial Intermediaries in which I participated in April 2021, organised by the SME Finance Forum in partnership with the International Finance Corporation, part of the World Bank Group.

Visit the strategy page on our website for more information about financial inclusion.