In our publication, Investing in fintech for greater financial inclusion, we describe investing in fintech as an opportunity to increase access to low cost, far-reaching digital solutions that hold the key to inclusive finance and better futures. Caspar says: “By investing in fintech for financial inclusion globally, we open pathways to financial services and basic needs like food and energy security. It improves peoples’ quality of life, and in the end that’s what it’s all about for us.”

First steps in building a fintech portfolio

Triodos Investment Management (Triodos IM) first began looking at the potential for financial inclusion through fintech and developing its knowledge and capability in 2014. At that time the fintech sector was new, complex and highly dynamic. New entrants in the market offering fintech services were mushrooming. In addition, traditional financial services providers such as microfinance institutions and SME banks were figuring out how best to integrate new technology opportunities into their business models.

Fintech improves peoples’ quality of life, and in the end that’s what it’s all about for us

According to Caspar, the early investment days were exciting: “It was something new, also exciting but making sense of it was challenging. Although we could see that the potential and promise offered by fintech totally aligns with our core purpose, we had to figure out how to meet the social objectives and the risk appetite of our funds. In the end, we realised we needed to take a step back and leverage off our strengths and experience in financing SMEs through intermediaries.”

Triodos IM made the first fintech investment in 2016 in Accion Frontier Inclusion Fund, a venture capital fund providing early-stage equity to fintech companies focusing on financial inclusion. It provided Triodos IM with a partner that had a grassroots presence in financial inclusion. Caspar says: “We were able to diversify the risk across different investees, build our own knowledge with a like-minded partner, and ultimately generate a solid pipeline in a responsible way for our funds. Also, it helped to break down the container term fintech and to develop specific approaches for specific sub-sectors, from online lending to payment systems, and from digital wallets to so-called neo-banks."

Direct investments followed a few years later, and because Triodos IM was more of a growth stage type of investor, focusing on traditional financial institutions, it had to adjust its investment criteria and create new guidance, tells Caspar: “We eventually developed a venture finance strategy, because you can’t do fintech without doing early-stage investing.”

He elaborates: “Financial institutions are highly regulated and have diversified portfolios so managing that kind of relationship is easier, but, with fintech companies, especially pre-profit stage ones, we had to recalibrate our comfort levels.”

The promise of fintech

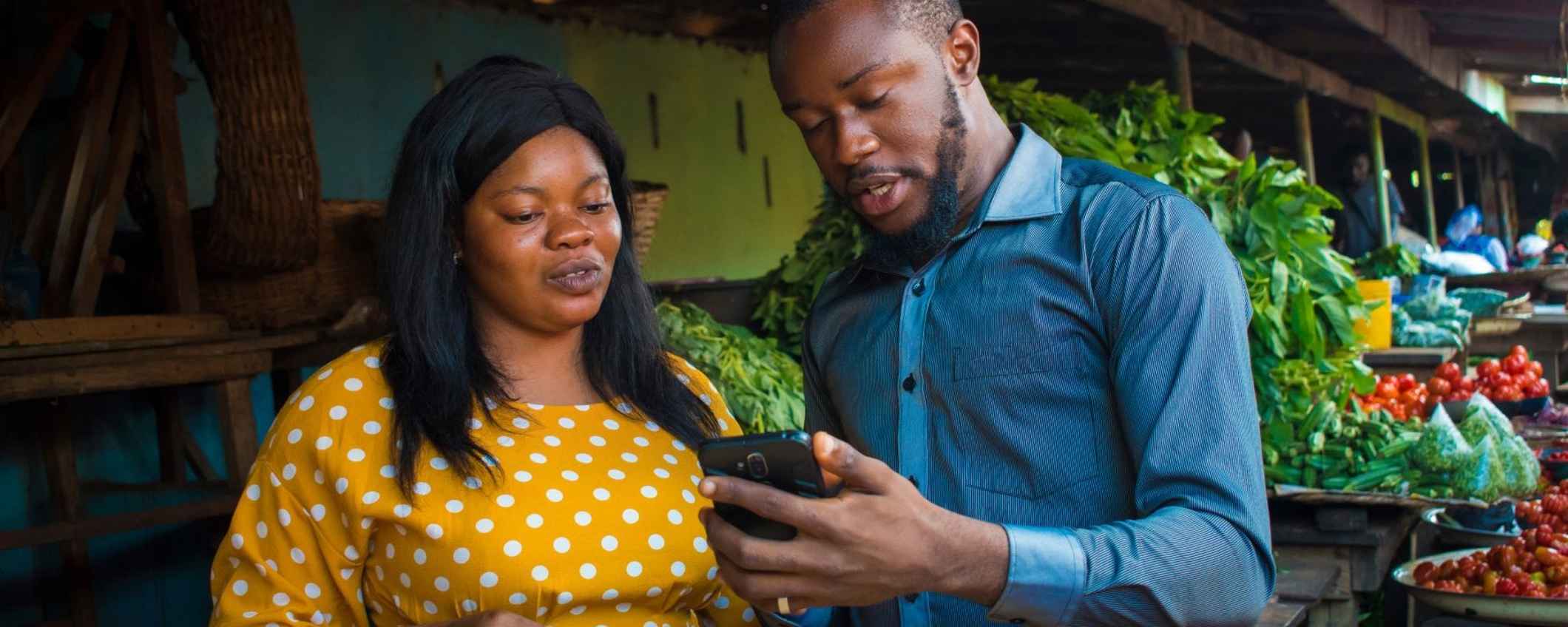

Fintech can be described as the digital transformation of traditional financial services providers and more recently as new, non-traditional, disruptive entrants in the financial industry. It offers its services in diverse and numerous ways, often with innovative business models, and has attracted the attention of investors, consumers and regulators globally. Triodos IM believes that well-regulated, fintech can benefit those in developing and emerging economies because they open access to finance to low-income households and micro, small and medium-sized enterprises. Operating as a network of many sub-sectors, it also has a strong social dimension that not only improves the accessibility, affordability and quality of financial services but it also opens the door to other opportunities and services.

Our paper 'Investing in fintech for greater financial inclusion' explores financial technology as a tool for greater financial inclusion, specifically in emerging and developing markets. Download it here.

Portfolio diversity

The strategy was successful and Triodos IM now has more than EUR 100 million invested in three core funds and 19 portfolio companies. Financing is provided through either debt, equity or mezzanine instruments.

A recent addition to our fintech portfolio is South African UsPlus. This company provides working capital to SMEs by offering tailor-made financial solutions. It allows SMEs to sell their invoices to a third party at a discounted rate in exchange for immediate cash.

Kenya-based Apollo Agriculture is a great example of an embedded finance investment, which through its integrated and digitised approach, is able to reach smallholder farmers and improve their earnings and food security.In addition to providing loans to small-scale farmers, Apollo bundles farm inputs, farming advice, weather forecasting, insurance and market access. Every farmer receives tailor-made agricultural advice on his/her mobile phone. This helps farmers maximise their crop yields and therefore their potential profits. Satellite data and machine learning enable better credit decisions, and automated operations keep costs low and processes scalable.

Selecting the right type of investment

Triodos IM’s fintech investees need not be frontrunners but must be likeminded and share the same vision and objective for impact and financial inclusion. Even if they tick the boxes of mandates, revenue levels, portfolio sizes, and their outlook on achieving break-even within a specific timeframe, the most important thing is that they are truly aligned with Triodos IM’s mission and vision. Caspar explains: “Often early-stage companies will need to shift their business model or strategy as they grow, to adapt to a changing environment or new market opportunities. If we share the same vision for financial inclusion, we know that when they adapt they will remain consistent with our impact objectives.”

Investment decisions also align with market needs so understanding the regional differences is important. Investing in fintech for greater financial inclusion describes in detail how Latin America and some Asian countries are seeing more innovative business models and the demand for venture capital starts shifting towards growth stage capital due to market maturity. In contrast, in Africa and South Asia, embedded finance models, such as Apollo Agriculture, are gaining in ground and popularity.

What’s next for fintech at Triodos IM?

There are two key developments according to Caspar. Business models are continuously evolving and offering a range of additional products to meet the needs of customers, and some are even becoming fully-fledged digital banks. The other major development in the market is the exponential growth of embedded finance companies that provide fintech to better deliver their product or service.

If you want to promote inclusion you have to promote fintech

Triodos IM is keen to invest in different subsectors. Embedded finance will play a huge role. "Right now we are focused on agri and clean energy, but we see positive impact and sound business potential in other needs like education and healthcare."

Caspar concludes: "Financial inclusion is our core and fintech is the next wave, it’s the future of inclusion. If you want to promote inclusion you have to promote fintech."