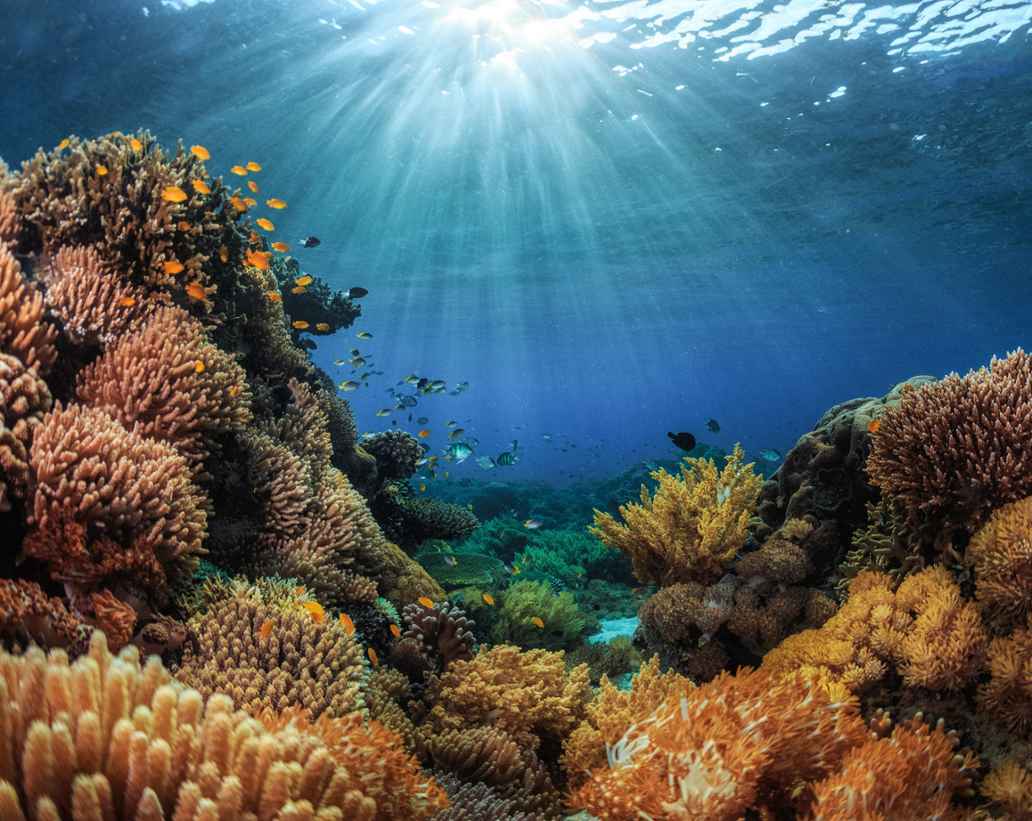

Sunday 22 May is International Day for Biological Diversity, a day promoted by the United Nations to raise attention and awareness on diversity of life on Earth and the risks it faces. Biodiversity is a characteristic of ecosystems that contributes to their resilience in uncountable ways, such as through climate regulation and water purification, or through the formation of healthy soils. The current rate of extinction of living species is tens to hundreds of times higher than the average over the past 10 million years – and the trend is accelerating. The list of worrisome information on the topic is long, but we hopefully do not need to get all the data to get the point: biodiversity is at risk, and so is life on Earth as we know it.

Biodiversity and finance

By now it has become quite clear to the general public that money flows have an impact beyond their direct effect on the parties involved in the transactions, and that they can have severe, and too often detrimental, very concrete effects on nature and our environment through the financing of harmful activities. At the same time, it has by now also become widely acknowledged that the financial sector itself is exposed to environmental risks, which can undermine the stability of the financial system: environmental breakdown is now understood to represent a serious financial risk. The link between financial activity and biodiversity is specifically highlighted in the EU SFDR regulation, which now mandates disclosure on negative biodiversity impacts for asset managers and other financial actors. While nature conservation and restoration has long been a prerogative of government intervention, with private institutions mainly providing funding through grants and donations, the World Wildlife Fund also highlighted how the private financial sector can play a vital role in redirecting funds towards activities that contribute to nature’s conservation, protection and restoration.

Only if we acknowledge that we humans are part of nature can we really re-centre our priorities, and make truly constructive, coherent decisions.

An important portion of the financial industry is therefore mobilising to get a better grip both on environmental risks for portfolios, as well as on the impacts of financial activities on biodiversity and the environment. Many financial institutions are joining initiatives and adopting tools to measure, monitor and reduce environment-related financial risks and improve their decision-making in this regard.

The right direction?

The consideration of biodiversity in finance is living real momentum, with many important initiatives and enthusiasm of market players that are creating new financial streams to close the funding gap in support of biodiversity. However, such efforts may prove to be short-lived if we do not address the roots of the problem: the individual and collective behaviours that brought earth’s ecosystems in such a deplorable state.

We need to go way beyond the direct impact of economic activities on nature: the biodiversity challenge calls for a complete rethinking of our economic system and cannot be tackled through ad-hoc interventions alone. There are deep economic axioms and cultural patterns that fundamentally drive biodiversity loss, which largely have to do with a growth paradigm based on value extraction, not least from the natural environment.

This is true both for individuals as well as for organisations, not least financial institutions. Any honest effort by the financial sector to do something about biodiversity loss must have the wellbeing of planet and society at its heart, not just the prospect of financial returns, and even less so risk avoidance. Financial institutions need to intentionally pursue non-financial value, embedding it in all their practices and processes.

Triodos Bank’s call: clear intentions and priorities

At Triodos Bank, we view finance as an instrument at the service of society, and we strongly believe in the opportunity for groups and individuals to make their money actively work for positive change. The focus for financial institutions should be on channelling money in ways that contribute to healthier societies and individuals, but individual and societal wellbeing are not sustainable when natural ecosystems are not in balance. It is therefore essential to limit possible harm to nature to a minimum and foster activities that support balanced ecosystems wherever possible. At Triodos Bank, we have historically focused on fostering fairer and more sustainable food and agricultural systems, and forms of energy that only rely on renewable sources.

Only if we acknowledge that we humans are part of nature can we really re-centre our priorities, and make truly constructive, coherent decisions. An approach based on risk considerations is not enough to achieve this: banks and financial institutions need to intentionally put people and the environment on top of their list of priorities, re-establishing the role of finance as an intermediary for broad societal wellbeing.

A holistic approach to biodiversity loss is therefore required, focusing on three courses of action:

- Do no significant harm: Stop funding to those activities that are already widely recognised as highly detrimental for nature, such as burning fossil fuels, the extensive use of chemical pesticides and fertilisers, etc. This is probably the biggest impact that financial institutions can quickly deliver: not financing irreparable harm.

- Foster solutions: finance alternatives and substitutes to the most environmentally harmful products and practices, and direct funding towards nature-positive activities and nature-based solutions.

- Address deep drivers: we simply cannot continue extracting and consuming resources as we have done until now. We must build new systems and incentives to truly turn the tide, starting with prices that more accurately reflect the value of natural resources.

Anything less will not do. All the above points require striking a reasonable balance between social and environmental priorities: this is already complicated enough, without adding financial return expectations to the equation. And while financial institutions might be tempted to wait for access to better data for more informed, more efficient decision-making, let’s be honest: we already know what needs to be done to “build a shared future for all life”. Let’s not wait any longer.

International Biodiversity Day

This year’s theme for Biodiversity Day is “Building a shared future for all life”. It is a strong call to action: 2022 is indeed the year in which the international community is called to set a clear, collective path towards biodiversity conservation and environmental restoration and regeneration. A concrete action plan is expected to be adopted during the second and last part of the UN Biodiversity Conference (COP15), which will take place in late 2022 in Kunming, China.

The Kunming COP15 is expected to play for biodiversity a similar role as COP26 in Paris played for international alignment and cooperation on climate change: setting shared targets for the reduction of biodiversity loss through the adoption of a post-2020 global biodiversity framework. In the words of the Convention on Biological Diversity, “The framework provides a strategic vision and a global roadmap for the conservation, protection, restoration and sustainable management of biodiversity and ecosystems for the next decade”.