For the past two years, our Impact Equities & Bonds (IE&B) team has been engaging with listed companies that have been identified as having excessive remuneration. In ‘Engaging with companies about executive remuneration’, we shared our approach to executive compensation and highlighted some engagement successes in 2021. In 2022, we expanded our engagement list to include three more companies while excluding three other companies that were divested from our portfolios in 2022 (for reasons not related to this engagement project).

Remuneration assessment

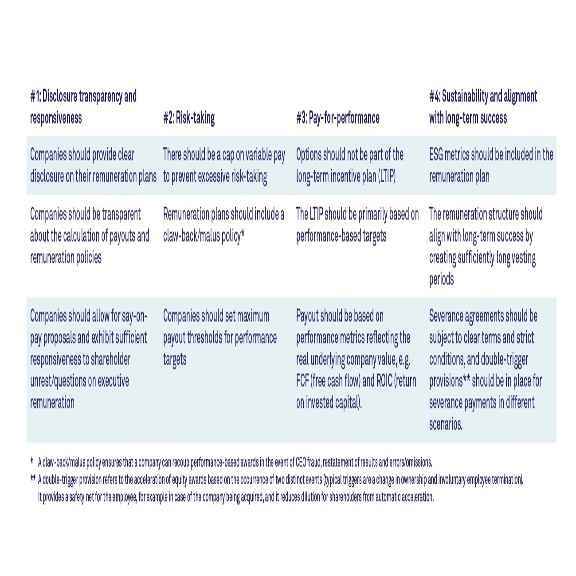

We analyse the remuneration packages of the companies with excessive remuneration using a remuneration best-practices framework. The table shows our remuneration principles.

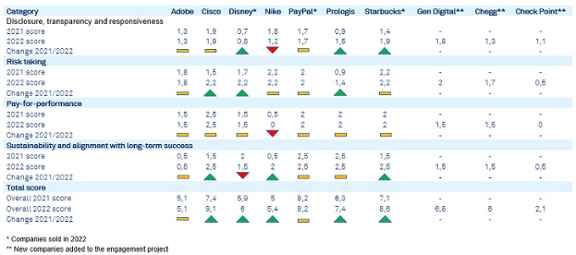

Based on this analysis, we rate companies on a scale of 0 to 12. For each of the four categories mentioned in the table, a maximum of three points can be earned. For all the companies that we engaged with in 2021, we witnessed some improvement (five companies) or a stable score (two companies), with Cisco showing the most significant improvement. Check Point received the lowest score as its variable pay consists entirely of stock options and is not based on performance. It has developed this way as the CEO was also the founder of the company. Since most shareholders, excluding Triodos IM, support its remuneration proposal (~90%), there is limited hope for change. If Check Point cannot show any improvement following our engagement, the company is a candidate for exclusion due to its excessive remuneration and flawed remuneration structure. The table below displays the summary of the scoring of the compensation packages. In 2022 and early 2023, we had meetings with all companies in the engagement program except Adobe (to whom we conveyed our concerns via email communication and with whom we aim to schedule a meeting in 2023).

Proxy voting 2022

We vote at the AGMs (Annual General Meetings) of all the companies we are invested in. We have a strict set of guidelines on remuneration resolutions. When determining how to vote, we consider various factors, including the CEO's level of compensation, the ratio of CEO pay to that of the median employee, and the structure of the incentive plans. We also ask ourselves important questions, such as:

- Are options excluded from the long-term incentive plan (LTIP)?

- Are environmental, social, and governance (ESG) metrics included in the plans?

- Is the majority of the LTIP performance-based, rather than retention-based?

- How easy is it for the company to recoup or claw back performance-based pay in case of CEO fraud or restatement of results?

By examining these factors and asking these questions, we strive to make informed decisions when casting our votes. In 2022, we voted ‘for’ on remuneration-related resolutions 30% of the time (2021: 22%), and either against or abstain in 70% of cases. This increase in the proportion of votes ‘for’ could signal a gradual improvement in companies’ remuneration plans. Our 30% ‘for’ vote rate on remuneration-related resolutions compares to a ‘for’ vote rate of 76% for all our votes at meetings in 2022. This also shows that in proxy voting, remuneration is an important topic for us.

Pay-for-performance

There are various performance metrics that can be included in a company’s short-term incentive plan (STIP) and LTIP. In our view, performance targets should be relevant and challenging. Financial metrics can be classified into three categories:

- accounting metrics,

- stock price-related metrics,

- return and cash flow metrics.

Some may be prone to (fraudulent) manipulating accounting or reporting by executives to meet certain targets to receive their desired variable compensation. The section below outlines some pitfalls and best practices.

- Accounting metrics

Examples of accounting metrics include revenues, EBITDA, and EBIT, among others. We understand the rationale behind using these metrics, as it is based on operational performance, which is the best representation of a company’s success. A risk is that these metrics can be influenced by management via aggressive revenue recognition practices or via inflating margins by using adjusted EBITDA and EBIT numbers, e.g., classifying expense items that are recurring as ‘one-time’ or ‘exceptional.’ This could especially occur when the payout is fully dependent on reaching a certain threshold and there is no stepwise approach. - Stock price-related metrics

The most important stock price-related metric is total shareholder return (TSR). Metrics used in variable remuneration vary depending on the company and its industry; however, in the United States, total shareholder return (TSR) remains a widely used metric. TSR emerged as a leading metric for long-term incentives following the Dodd-Frank Wall Street Reform in 2010. Companies can use either absolute TSR, relative TSR (compared to a peer group) or a combination of both. One could argue that TSR is the perfect measure to align executive interests with shareholders. However, using absolute TSR could reward CEOs for a ‘market boom’ over which they had no influence. Applying relative TSR can excessively reward CEOs during times of crisis. In addition, using TSR as a performance metric could incentivise CEOs to engage in profit hunting at all costs, making the business less sustainable in the long term, or worse, potentially committing fraud by cooking the books. Overall, TSR has a too limited scope, as it does not reflect the broader impact on the company and other stakeholders, and only has a short-term focus. - Return and cash flow metrics

We like return and cash flow measures best.Cash flow measures consist of either free cash flow (FCF), cash flow from operating activities (CFO), or the cash conversion rate. Unlike EBITDA and EBIT, cash flows often better depict the financial state of a company and cannot as easily be influenced. The return on invested capital (ROIC) is an example of a return metric. ROIC is a ratio that depicts how efficiently a company uses its capital, i.e., the profit it derives from it. Given that it is hard to manipulate this ratio, this is deemed to be a good metric for CEO remuneration. It incentivises a CEO to look for efficiency gains.

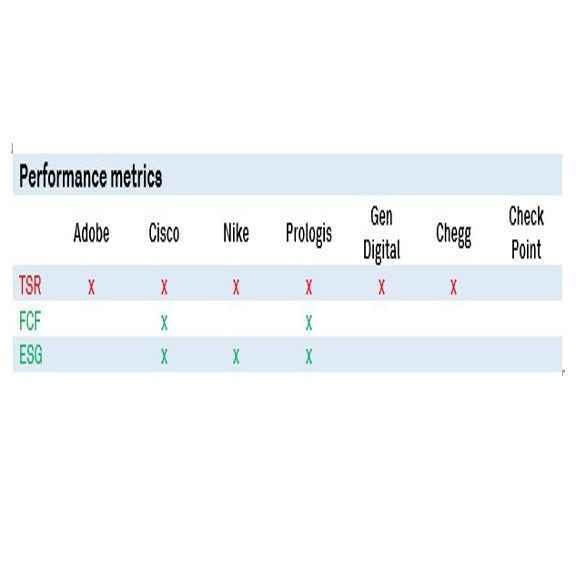

Of the seven companies included in our remuneration engagement program, five use relative TSR as an LTIP metric: Adobe, Nike, Cisco, Prologis, and Gen Digital, while Chegg uses absolute TSR. The only company not using TSR, Check Point, has no performance-based pay at all. Cisco and Prologis use FCF as a performance metric in their LTIP, which we like. The implementation of just and fair performance metrics, thereby placing the right incentives, remains an important agenda point in our engagement with these companies.

Qualitative metrics

Next to financial metrics, non-financial or qualitative metrics are becoming increasingly popular. Prime examples of this are the environmental, social and governance (ESG) metrics. The integration of ESG criteria in the executive remuneration plan may incentivise management to strengthen its strategic orientation towards (the transition to) a more sustainable economy and stronger sustainability performance. Overall sustainability goals can be derived from the Sustainable Development Goals (SDGs), the 2015 United Nations Climate Change Conference (COP 21), or other frameworks and initiatives.

While it is easy to commit to sustainability goals as part of corporate strategy, the introduction of ESG performance metrics that executive pay can be linked to is more complicated. Clear, quantitative ESG metrics measures or specific goals must be defined and should be meaningful to the company’s business model. They should therefore be carefully chosen.

Of the seven companies included in our remuneration engagement program, three have included ESG metrics in their remuneration plans so far: Prologis, Cisco, and Nike. The latter two companies had not yet included such a metric when we first engaged with them in 2021.

Engagement highlight – Signify and Acuity Brands

Even though both companies do not have excessive remuneration schemes according to our Minimum Standards, we engaged with Signify and Acuity Brands on remuneration as part of our regular engagement with them. Also in this case, we still like them to improve their remuneration structure.

We have been engaging with Signify for several years, at both management and supervisory board level, is Dutch lighting company Signify. When it comes to remuneration, the dialog can be considered to have been constructive. Not only has the company refrained from excessive remuneration, as per Triodos’ minimum standards, also the compensation framework has been improved over time to a framework that is among the better in our investment universe. For example, both the STIP and LTIP of Signify include sustainability related metrics, with 25% of the LTIP linked to Signify’s Brighter Lives, Better World 2025 program. This program covers a variety of ESG topics with clear targets, among others related to carbon footprint reduction, circular revenues, and women in leadership positions, with Signify reporting annually on the progress it is making against its targets. Furthermore, while we are not big fans of the use of TSR as a metric in long-term incentive plans, because there is quite some dependency on factors outside of the company’s control, we were pleased that the relative TSR threshold was increased in 2020 (now Signify must outperform at least 10 out of 15 peers for the CEO to be awarded a bonus, vs. at least 8 out of 15 peers before). Such a threshold is important in our view, as it prevents management being granted an incentive while the company’s share price performance has been sub-par. In addition, the mix of relative TSR in the LTIP has been decreased from 40% to 25%. Next to sustainability and relative TSR, the other LTIP metrics are ROCE and FCF, also each accounting for 25%.

We recently also engaged with CEO Neil Ashe and CFO Karen Holcomb of Signify’s US competitor Acuity Brands. Although not yet at the level of Signify, Acuity Brands has been improving its remuneration framework in recent years. For instance, Acuity Brands’ short-term incentive plan not only includes key financial metrics (sales, operating profit and FCF) but also looks at individual performance goals, which include ESG goals. These goals are aligned with plans and initiatives outlined in the company’s annual EarthLIGHT report, although we would welcome greater disclosure on the specific targets that have been set and the progress being made. Regarding the remuneration framework for fiscal 2023, we discussed the addition of a relative TSR target to the long-term incentive plan, with the TSR to be measured against the S&P 400 Capital Goods Index. As mentioned before, we are not big fans of (relative) TSR, but it was good to hear from management that at least there will be a threshold of the 25th percentile compared to peers, before any bonus is awarded. However, we would have preferred a more ambitious threshold, as is the case at Signify.

Continued monitoring

The starting date of our executive remuneration engagement project in 2021 is our baseline for progress measurement. We will continue to monitor the pay levels and pay gaps, as well as evaluate the compensation structure against the set principles. We will also continue our engagement with the targeted companies on a yearly basis and will vote against remuneration arrangements that do not meet our standards.

While it is highly unlikely that companies will reduce the level of executive pay solely because of our engagement efforts, our active involvement may well contribute to sustained momentum in this direction. Regarding transparency and the inclusion of ESG metrics in compensation plans we have already seen several positive developments. Lack of progress could lead to divestment.