UNI2 Microcrédito (UNI2) was founded in 2014 by local entrepreneurs with the purpose of promoting financial inclusion. They witnessed the inequalities in the financial sector and recognised that a huge part of the population, especially in rural areas, had no or limited access to basic financial services. As one of the few financial institutions, UNI2 operates in post-conflict areas where poverty rates are high.

Their focus on underserved areas and populations makes UNI2 stand out in the financial landscape of Colombia. Those living on a low income rarely access financial services through the formal financial sector – UNI2 changes this: 40% of their clients are first-time borrowers; average loan size is USD 1,500.

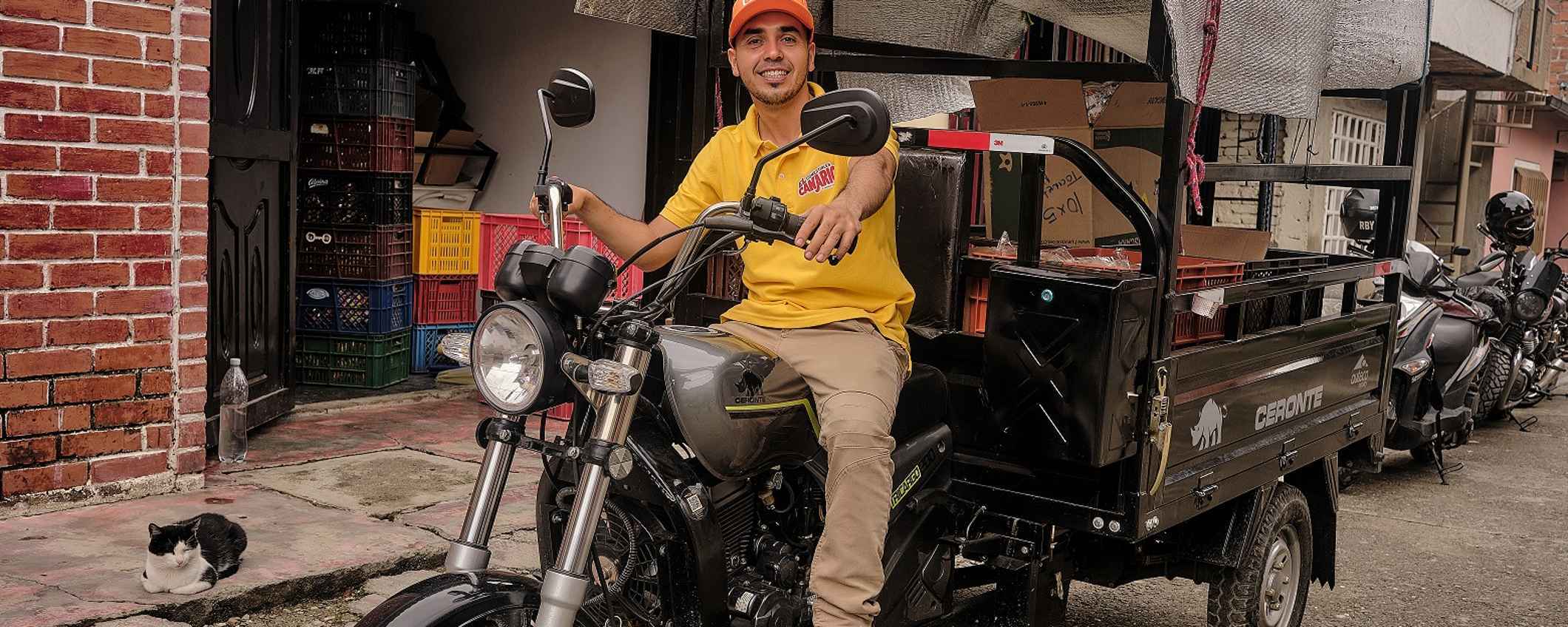

UNI2 focuses on four specific products: agricultural loans for smallholder farmers, working capital, motorcycle loans and vehicle finance (small trucks for self-employed). With their motorcycle and vehicle finance UNI2 responds to an important need as the mobility infrastructure in rural and post-conflict areas is underdeveloped.

The debt facility provided by Triodos Microfinance Fund and Triodos Fair Share Fund will enable UNI2 to further expand its loan portfolio.