Triodos Bank has the ambitious target to reach net zero by 2035 and contribute to limiting global warming to 1.5°C to prevent the worst effects of climate change. Our long-term net zero target covers all financed emissions of Triodos Bank including the complete range of funds managed by Triodos Investment Management and the company’s own operations.

This means we need to work closely together with our clients, investees, co-workers and other stakeholders to reduce emissions. Engagement with companies in our Impact Equities and Bond (IEB) portfolios is part of this effort. In 2023, we stepped up our engagement efforts by setting the target to engage annually with these holdings on GHG management.

Climate engagement

As an active shareholder, we continuously monitor the companies we are invested in and aim to maximise positive impact by having a constructive dialogue with them. Focusing our efforts to meet our main objective, we use two complementary approaches. The first approach is to focus on companies that are still in the early stages of establishing a climate change strategy. These companies can greatly improve their strategy by setting targets that are science-based. In the second approach, we also focus on the highest emitters in our portfolio, as reducing emissions for this group can substantially contribute to our total emissions reduction. We identified the five biggest direct emitters per fund and prioritised them for engagement.

When engaging on GHG emissions with publicly listed companies, several challenges arise. Some of the most common problems include a lack of GHG measurement guidelines (especially scope 3), which results in reported GHG data and targets that are not comparable.

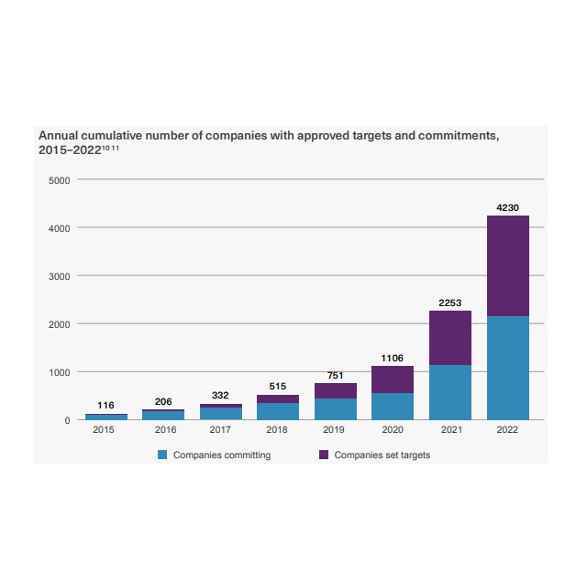

Having companies set a target in line with the SBTi helps in minimising the existing problems with (scope 3) data and target comparability as companies follow a common scientifically recognised methodology to calculate their emissions and to set targets. Notably, the SBTi is currently reviewing its approach on scope 3 target setting as well as developing resources to guide the adoption, implementation, assessment and tracking of scope 3 targets in a robust and consistent way. In 2022, the SBTi reported a sharp rise in the number of companies setting science-based targets (see figure 1), with 87% more companies having their targets validated that year (1,097) compared to 2021. This is a number greater than the entire previous seven years combined (1,082).

Yet, solely setting SBTi targets might not be enough. In a recent study, the Massachusetts Institute of Technology (MIT) concludes that firms obtaining assurance for their carbon accounting report on average have a 9.5% higher carbon intensity than their peers. However, when controlling for assurance, firms obtaining assurance for their GHG emission data reduce their future carbon intensity by 3.3%. This suggests that taking reported carbon emissions at face value would lead to penalising firms that are more serious about their carbon reductions. While the authors call for mandatory assurance, we are already pushing our companiesto seek for third party assurance to ensure that the SBTi methodology is applied effectively.

Late and unwilling movers

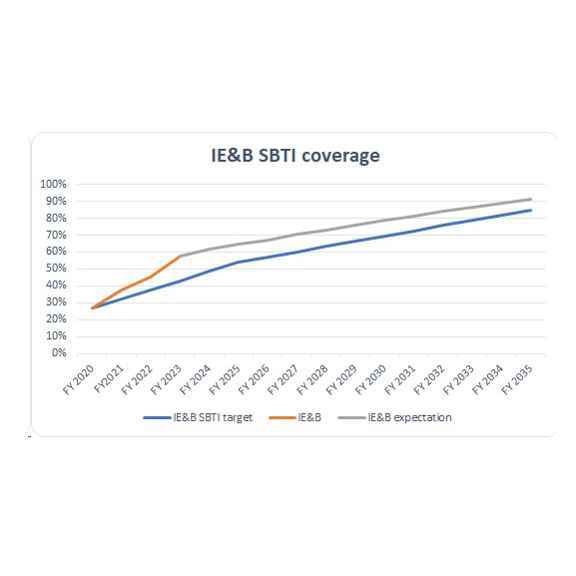

While the recent steep increase in SBTi adoption should be celebrated, we think that it is merely the result of a group of early movers, for whom it was relatively easy to set targets. These early movers are for example companies that can more easily and directly influence their scope 1-3 or that are intrinsically motivated to improve their practices. Now it’s the late movers’ turn and hopefully they will be followed by the unwilling movers (i.e. those companies who see setting such targets as a burden). These last two categories are much harder to convince. For that reason, we expect growth in the number of our portfolio companies setting science-based targets to flatten towards 2035 (see figure 2), diminishing the gap between 2023 and 2035. Notably at the end of 2023, 57% of our IEB portfolios by net asset value had set SBTi validated targets, while 10% was committed to doing so.

Deep dive into GHG reduction strategies

In 2023, we also took a deep dive into the GHG reduction strategy of our Top 5 GHG emitters per fund as per year-end 2022 and tailored our analysis to their business models. The long-term goal of this project is not only to encourage companies to set SBTi targets but to also advise them on how to stay aligned with those targets as well as how to improve them. Deep-dive assessment comprises more advanced discussion points such as the consideration of updates from the SBTi (e.g FLAG SBTi), GHG bonus related incentives, the quality of a company’s offsetting program or the level of engagement of a company with third parties to better understand their ability to decrease their scope 3 emissions.

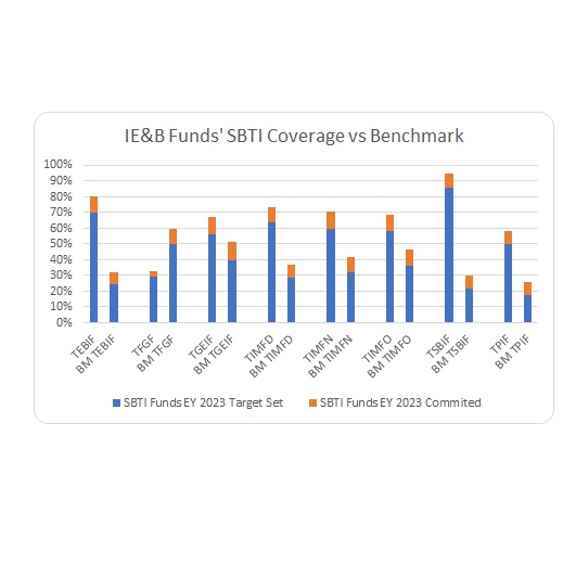

95% of the GHG emissions of the top 5 emitters in our portfolios, is the result of their scope 3 operations. This is no surprise, as the highest scope 1 and 2 emitters are often companies within the oil and gas industry, which we do not finance. Also no surprise is the fact that the largest emitters can be found in the Cyclical Consumer Goods industry, with companies such as Toyota, Continental and adidas that require relatively big amounts of energy to operate. Most of the highest emitters - 77% - have set SBTi targets. Notably, almost all our listed equity and bond portfolios scored better than their respective benchmark when it came to setting science-based targets (see figure 3). This is also the result of our investment strategy of building high-quality portfolios when it comes to sustainability practices.

Engagement highlights

Most companies are quite willing to discuss their GHG strategy, even if several indicated that they were still relatively early in the process of GHG measurement. This last argument is often used by non-EU companies, where sustainability reporting requirements are less strict and consumers as well as investors are less demanding on this topic.

| Top five polluters per IEB fund | |

| Acuity brands | Evonik |

| adidas | Henkel |

| ASML | Kerry |

| Bridgestone | DSM |

| SABESP | Meidensha |

| Continental | Procter & Gamble |

| Danone | SNCF Reseau |

| Deutsche Post | Toyota Motor |

| DS Smith | Vestas Wind Systems |

| East Japan Railway | Vodafone |

| Essity | Wolfspeed |

There is an overlap in the top five emitters per fund. | |

The engagement examples below provide a more concrete flavour of what has been achieved,as well as what we intend to achieve through our engagement.

Ongoing proactive approach

The starting date of our deep dive engagement on GHG management practices in 2023 is our baseline for progress measurement. Focusing on the top 5 emitters was a start and we are planning to increase the coverage in the coming years. Data from new external providers will allow us to better assess if companies have the capital to follow up on their promises. To increase our chances of success in having companies change their practices, we are also looking into the opportunity to partner with other asset managers. For now, we mainly do so by signing engagement initiatives such as the CDP science-based target campaign, which grew 13% last year to represent USD 32 trillion of assets under management, making this collaborative effort one of the largest investor engagement campaigns in the world. Also by voting we will try to move companies to align with the target of the Paris Climate Agreement. Lastly, we are continuously updating our engagement discussion points to ensure that we leverage to the maximum the latest findings on climate change.

All in all, things are moving in the right direction when it comes to engaging with listed companies on climate change. As mentioned, however, we believe that the most difficult part is still to come. We will therefore continue our proactive approach by promoting the best practices as well as by continuously looking for new opportunities to partner with others to further leverage the impact of our engagements and to help companies in reaching the Paris Climate Agreement goals. We believe that, in the end, a company with good GHG management practices will, apart from less harmful to the environment, also be financially more resilient.