The impact of tipping points—those thresholds where small changes trigger cascading, often irreversible shifts—calls for awareness and adaptability in every investment decision, because they affect financial markets at an increasing speed. The interplay of these forces is a unique opportunity to drive impactful, lasting change while safeguarding returns.

Navigating the polycrisis: A new reality for investors

The state of our world economy is incomparably different than at any time in history. The Earth's environmental systems are dire; some are on the brink of collapse1. In many societies, we face challenges of polarisation and fragmentation, leading to unstable governments. The global economic system is shifting from a neoliberal economic regime – one undermining itself through worsening instability, inequality, and ecospheric externalities – to a yet indeterminate regime, but one likely involving increased dirigisme and economic integration within ideological blocs.

We are grappling with what experts call a 'polycrisis'—a convergence of critical risks across economic, environmental and social systems that together create a heightened level of fundamental uncertainty2. Unlike previous decades, today’s crises are deeply entangled, from climate threats to social fragmentation and geopolitical shifts.

This polycrisis demands a fundamentally different approach to investing. One of the causes of the global nature of the polycrisis is reflected in today’s financial market: highly globalised and deeply connected. The impact of tipping points—those thresholds where small changes trigger cascading, often irreversible shifts—calls for awareness and adaptability in every investment decision, because they affect financial markets at an increasing speed. The right move could generate extraordinary returns, while the wrong one could expose a portfolio to unexpected vulnerabilities.

Tipping points explained

In ecosystems, social systems, and economic systems tipping points can lead to irreversible changes, either improving or worsening the state of a system. These shifts can render a strong investment worthless—or transform a weak one into a success.

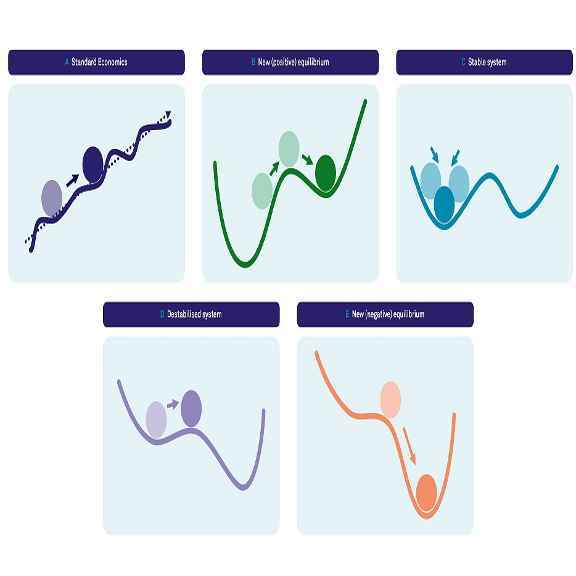

As illustrated in the figure below, a tipping point represents a critical threshold where external pressures cause a system to lose resilience, triggering self-sustaining changes to a new state3. Traditional investment analysis assumes linear growth with some uncertainty, as seen in panel (a). However, in a polycrisis era, non-linear changes are more likely.

System shifts may result from external shocks, such as natural disasters or political upheavals, or gradual pressures like climate change. Internal dynamics, like declining social cohesion or stagnant productivity, can also destabilise a system. In some cases, as shown in panel (b), these forces push the system toward a better state, driven by innovations or shifting social norms.

Systems can also maintain stability over time, as in panel (c), resisting external pressures. However, once resilience is lost, as in panel (d), destabilisation occurs. While recovery may still be possible, further erosion of resilience can result in a new, less favorable equilibrium, as depicted in panel (e). Examples include biodiversity loss, climate change or societal collapse. Understanding these dynamics is crucial for informed decision-making in complex, volatile environments.

What are we facing?

Ecosystems are nearing critical tipping points, risking collapse if overstressed4. This could lead to natural disasters and the loss of vital ecosystem services, threatening economic stability, as 55% of economic activity depends on nature5. Climate change effects are more severe than previously expected, disproportionately impacting poorer countries6 and raising the likelihood of systemic disruptions like 'climate flickering'—early signs of system collapse7.

Similar risks apply to social systems, where stable institutions and social capital are essential for societal and economic well-being. While this year’s Nobel Prize highlighted its importance, evidence shows that social capital is eroding in many Western nations8. Tipping points in social systems, which can be positive or negative, also have profound implications for economic prosperity9. Together, these dynamics underline the urgent need for action to mitigate risks and foster resilience.

What is the upside?

Not all aspects of the current global situation are negative. Technological tipping points, when new technologies reach maturity and outperform older alternatives, can lead to exponential growth and sometimes solve ecological challenges. For example, the energy transition towards renewable energy, electrification of transport, and battery storage can create a fossil-free economy.

However, technological success also hinges on social adaptation. Social tipping points, driven by positive feedback loops, can amplify changes and lead to significant shifts in societal behaviors, norms, and policies, such as towards decarbonisation10. Investing in various transitions can help investors capitalise on the upside of solutions while building resilience against negative shocks. For instance, investing in companies not reliant on fossil fuels reduces exposure to transition risks and positions them in growing markets.

Investors must adapt to the polycrisis era by addressing two priorities: mitigating risks from negative tipping points and capitalising on long-term positive tipping points. Unlike the past, today’s risks are increasingly ecological and social rather than purely economic11. Effective risk management now requires excluding unsustainable practices - such as deforestation, pollution, and human rights violations - from portfolios, not as an ESG preference but as a necessity to avoid systemic vulnerabilities. It is essential to note that this is now more necessary than ever. Tipping points are approaching rapidly, which will mean that overexposure to these kinds of risks can lead to potentially high losses.

On the opportunity side, investors should focus on sectors and technologies driving long-term, sustainable transitions, though the systemic unpredictability of the polycrisis adds complexity. Practical steps include developing a clear vision of desirable transitions and identifying investments that align with these shifts, emphasising opportunities with the best risk-return profiles while minimising exposure to negative tipping points.

For investors, the challenge is to identify where these tipping points lie and anticipate their impact. At Triodos Investment Management, our strategy emphasises two key aspects: reducing exposure to negative tipping points and maximising potential in sustainable transitions. This means avoiding investments tied to unsustainable practices, such as fossil fuels, and seeking opportunities in sectors positioned for growth within an evolving landscape, such as renewable energy and energy storage. While we closely evaluate the economic outlook for 2025, our focus as long-term impact investors has always extended to the broader landscape of systemic, global, and unpredictable risks and opportunities.

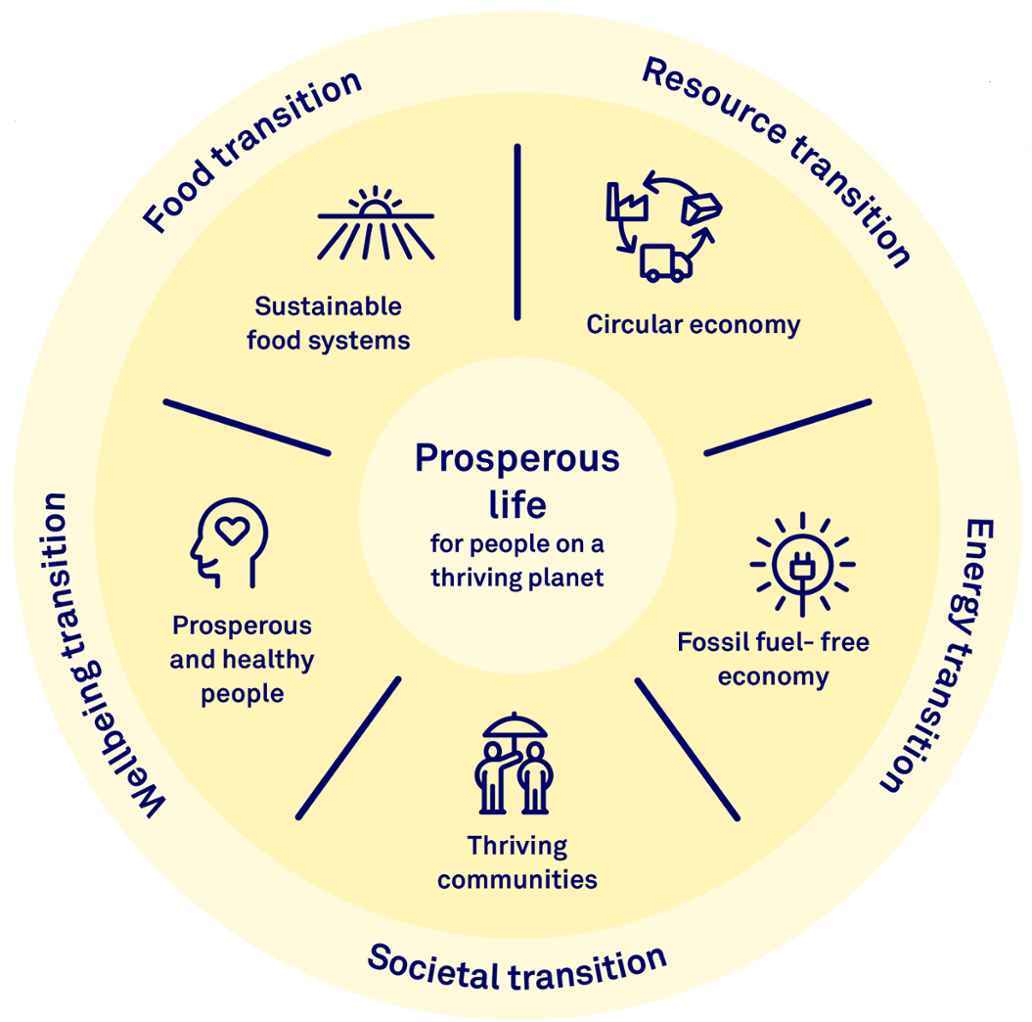

We always apply a 'tipping point approach' to investing, identifying transformative long-term opportunities that contribute to societal change while helping to prevent critical negative tipping points. Although no investor can entirely shield against systemic risks, this strategy enables us to minimise those risks and actively work toward sustainable solutions. Our approach spans five key transitions:

- Food

Investing in sustainable agriculture and food production to address food security and environmental impact. - Resource

Supporting circular economies and resource efficiency to counter waste and pollution. - Energy

Advancing renewable energy and clean technologies to decarbonise industries and reduce reliance on fossil fuels. - Societal

Promoting inclusivity, equity, and institutional stability to build resilient social systems. - Wellbeing

Investing in health and well-being to support quality of life in a changing world.

This holistic, transition-focused strategy allows us to act on both the risks and opportunities within today’s polycrisis. By selectively investing in areas primed for positive tipping points, we help sustainable systems to thrive while mitigating exposure to negative disruptions.

Our ‘tipping point approach’ represents a blueprint for investing in a time of radical change. It’s about building resilience, seizing opportunities for growth, and shaping a future that avoids critical negative tipping points. For investors, this is more than a strategy—it’s a way to turn uncertainty into transformative potential, ensuring that the world we invest in today is one we’re proud to leave behind tomorrow.