Triodos Future Generations Fund invested in Benesse ever since the launch of the fund in March 2022. Recently, the fund sold its position after the company announced that it would be taken private by its management, with the support from private equity investor EQT. They offered to acquire the company at a 45% premium compared to the last closing price before the offer was announced. Obviously, a solid financial success for the fund, but also an indication that small and midcap equities are becoming more interesting to equity investors.

Small and midcaps only temporarily out of favour

Benesse is not the only smaller company with an attractive valuation. In fact, compared to large caps, valuations of small and midcap equities are nearly at their all-time low. The chart below illustrates this. The MSCI World SMID Cap index typically trades at a premium to its large cap equivalent the MSCI World. Currently however, it’s the other way around.

There are various explanations for this difference. First, investors in listed equities are currently predominantly interested in artificial intelligence, a theme dominated by the large tech companies, also known as the magnificent seven. Another explanation is that smaller companies tend to be more sensitive to changes in interest rates. This is because they usually have more debt on the balance sheet and are more reliant on financing from banks. Rising interest rates thus had a negative impact on the performance of small and midcap equities.

Yet things are starting to turn. In the US, January of this year saw the highest numbers of M&A transactions in small and midcap equities in 30 years. Both Triodos Future Generations Fund and Triodos Pioneer Impact Fund also had several of their holdings targeted for acquisitions. Besides Benesse, these include Blackbaud, Chr. Hansen, Millicom and recently also DS Smith. So, the valuation of small and midcaps seems attractive enough for strategic acquisitions or buyouts.

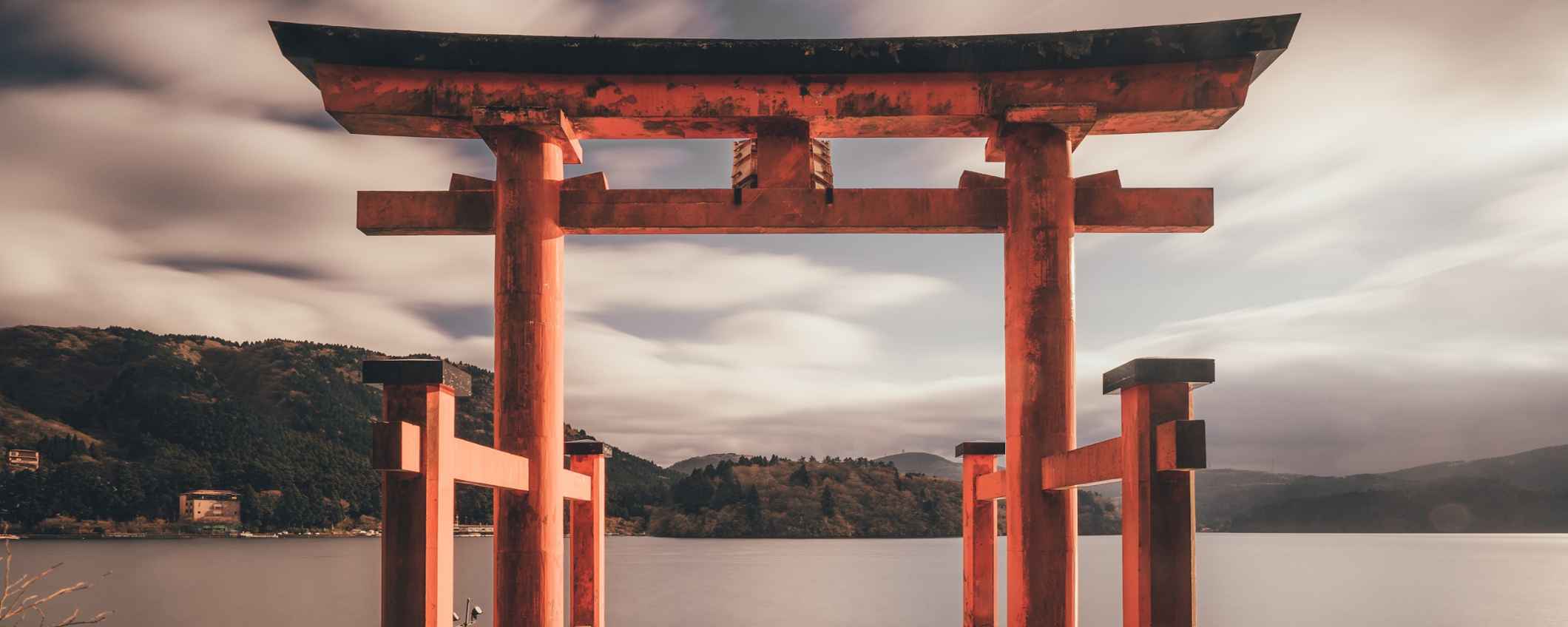

Corporate governance reform in Japan

Another positive development we see, specifically concerns Japanese companies. Japan is making a very serious corporate governance reform effort. The country is known to have many listed companies that trade at a discount to the book value per share. The Tokyo Stock Exchange is now pushing these companies hard to adopt practices that will improve their capital efficiency and remove this discount. This includes naming and shaming of those that do not comply. And this is working because many companies are taking action. Others may decide to end their listing on the stock exchange and follow the example of Benesse. Regardless, it suggests that Japanese small and midcaps may offer good return opportunities.

All in all, there are good reasons to look beyond prevailing trends and consider developments that may not directly catch the eye. The investment case for small and midcaps is a good example of that.