Small- and mid-cap stocks are gaining renewed appeal. While predictions about future market performance are always subject to uncertainty, historical data and present market conditions suggest that these stocks offer notable advantages compared to their larger counterparts.

Why now?

Numerous facts and datapoints in the current market that have historically been reasonable indicators of a positive performance of small- and mid-cap stocks are at play again. We highlight three.

Poised for an upswing

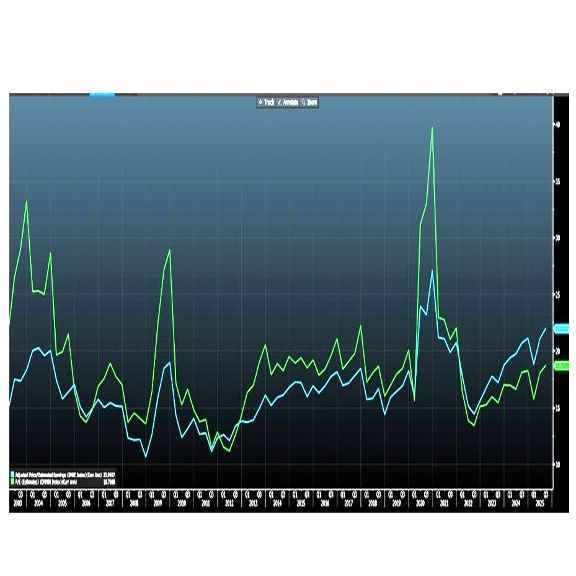

The current valuation of small- and mid-cap equities relative to the wider market is notably compelling. The chart below shows the valuation of the World Index (blue line) versus the World small- and mid-cap index (green line) over the last 23 years. Based on the P/E as a valuation indicator, small and mid-caps historically traded at a premium (green line above the blue line).

However, since 2021, this relationship has reversed, primarily due to the outsized performance of large caps, particularly the so-called ‘Magnificent Seven’. Small and midcaps now trade at a rare valuation discount, despite their history of superior earnings growth. With markets tending towards mean reversion, this strongly implies that small and midcaps are poised for an upswing. It is noteworthy that Triodos Pioneer Impact Fund and Triodos Future Generations Fund are priced even more attractively than the index, while their underlying holdings exhibit higher projected earnings growth - suggesting substantial embedded value.

Historical outperformance

Small and midcaps have historically outperformed large-caps when central banks commence interest rate cuts. With the Federal Reserve already reducing rates, prospects for these segments are brightening further.

Diligent research confers advantage

Small and midcaps are generally under-researched, creating inefficiencies and opportunities for active managers.This is certainly nothing new, but over the last few years the number of analysts researching small and midcaps has further declined. With fewer analysts following these companies, diligent research confers a distinct advantage, particularly for long-term institutional investors. Moreover, management of small- and mid-cap companies tends to be more accessible and open to constructive dialogue, enhancing shareholder and stakeholder engagement.

Pure plays with growth potential

A more general good reason to invest in small-cap equities is that they provide targeted investment exposure, particularly in impact investing which seeks solutions to global challenges. Such ‘pure play’ companies typically concentrate on a single product or service, affording investors a clear thematic entry point. These companies generally tend to be more innovative and agile, and less encumbered by bureaucracy than their larger counterparts.

Moreover, smallcaps with robust strategic propositions typically have their growth trajectory ahead of them. While they may appear less profitable and highly valued initially, those with compelling products or services possess substantial future upside. As these companies expand, increased analyst coverage and investor interest can drive share price appreciation, market capitalisation growth, and potential index inclusion.

The proof of the pudding

A prime example of an attractively valued stock in our portfolio is US company Cooper Companies. Cooper is a high-quality name with above-average revenue growth and high margins. Its cash generation is robust; recently the company also announced an additional 1 billion USD buy back - bringing the total to USD 2 billion. This is around 16% of its current market cap. Cooper is active in the soft contact lenses market (two thirds of revenues), where it has a market share of ~25%. The other third of revenues is derived from the company’s surgical business, which focuses on female health. Cooper is trading at a modest P/E of below 15 times versus 26 times on average over the last five years, making it an attractive investment.

Another example is portfolio company Qiagen. This German company is active in biological sample technologies and produces consumables and instruments (around 88% and 12% of total revenues respectively) for human disease diagnostics, pharmaceutical research and academic research. A high portion of its total revenue delivers positive impact, contributing to the diagnosis of illnesses, the selection of the right treatments and advancement of scientific discoveries. Qiagen has a sound financial position with high revenue growth prospects and margins. Recurring revenues form a large part of total revenue, thanks in part to its strong brand name. The strong balance sheet offers flexibility for more dividends, buybacks and selective acquisitions.

Strong case

All in all, based on thorough analysis and a long-term perspective, listed small- and mid-cap investments can provide diversification, growth and alpha generation opportunities, supporting robust portfolio performance.

Given their historic undervaluation compared to largecaps, small and midcaps offer an opportunity to invest relatively cheaply in companies that, due to their smaller size, can often respond more quickly to changing circumstances and make a clear contribution to sustainable transitions.

Disclaimer

This is a marketing communication. Please refer to the prospectus and the KID of Triodos Pioneer Impact Fund and Triodos Future Generations Fund before making any final investment decisions. An overview of the investor’s rights can be found in the prospectus. The value of your investment can fluctuate because of the investment policy. Both funds are managed by Triodos Investment Management. Triodos Investment Management holds a license as alternative investment fund manager and UCITS and is under the supervision of the Dutch Authority Financial Markets and the De Nederlandsche Bank.