Once again, the resilience of emerging markets is being tested. The US administration’s America First approach and its erratic policies led to significant global uncertainty. This uncertainty, in turn, has led to a more conservative global growth narrative, resulting in lower oil and commodity prices, as well as financial market volatility. Emerging markets are adapting and demonstrating that they are avoiding becoming hostages to geopolitical tensions.

The cost of uncertainty

Policy uncertainty, ongoing geopolitical developments and new tariffs are significantly impacting economic forecasts, resulting in downward revisions of global growth projections, particularly in the US.

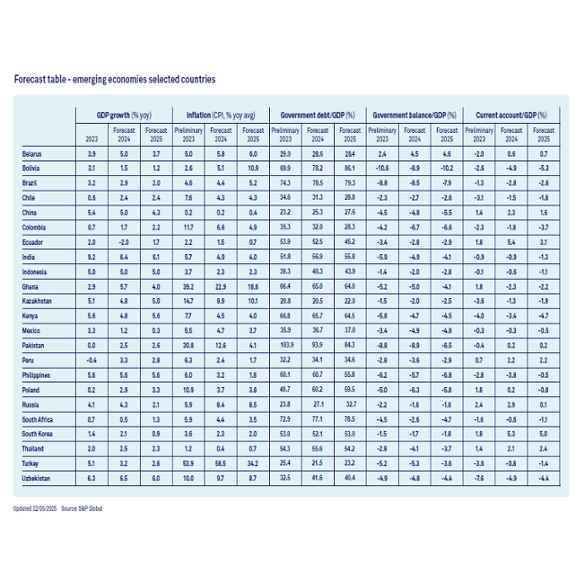

We anticipate that growth in emerging markets will slow to approximately 3.7% in 2025, below the 4% average of the past decade, but still more than double the GDP growth of advanced economies. If the supply shock from US tariffs proves temporary, average inflation in emerging markets may decrease to around 5% in 2025, down from 8% in 2024. However, this remains above the 2% target set by most central banks, with countries like Bolivia, Ghana, and Turkey experiencing double-digit inflation. China's inflation has remained flat at 0% over the past two years and is expected to stay at this level.

The US is now projected to narrowly avoid a recession due to a de-escalation of tariffs, a change from the mild recession anticipated last year. If the ceasefire in tariffs between the US and China holds, this could improve China’s GDP growth to 4.3% in 2025. Nevertheless, the long-term costs of policy uncertainty for the global economy are accumulating. Tariffs are likely to be negotiated at higher levels than at the beginning of the year, and concerns about the US fiscal stance persist. Moody's downgrade of the US's triple-A credit rating highlights potential challenges ahead, indicating that emerging markets will face both specific risks and external volatility from uncertain US trade relations and the US debt burden. To address their financing gaps, emerging markets require reliable foreign capital flows, especially as many governments have reached their limits in providing fiscal support post-COVID amidst a fragmented global economy. Private investment is essential to ensure continuity in transitioning toward a sustainable economy.

Impact of tariffs

The impact of US tariffs on emerging markets varies considerably across regions and is dependent on a country’s direct trade exposures to the US, and indirectly on supply chains, as well as on the potential of countries to respond to US tariffs by shifting exports to other countries.

- Direct impact:US tariffs reached their highest levels in a century on “Liberation Day,” April 2, with a baseline tariff of 10% and country-specific tariffs implemented later. Financial markets reacted, and while retaliation was mostly restrained, negotiations for lower tariff levels with the US are ongoing. China responded to US tariffs with a 125% tariff on US exports, prompting a US response of 145% tariffs on all Chinese exports, which were eventually reduced to 30% until August 10, 2025. Financial markets welcomed this ceasefire, anticipating that US tariffs had peaked.

The regional impact of tariffs differs. In 2024, Africa's exports to the US accounted for about 1% of global exports, with most countries' exports to GDP below 1%. Eastern European nations like Poland and Romania have closer ties to the US, but their exports still do not exceed 2% of GDP, being more dependent on Western Europe. Latin America, especially Mexico, has substantial trade relations with the US, with exports constituting around 27% of GDP. US tariff announcements have added pressure to Mexico’s manufacturing activities, despite Latin America facing the lowest US country-specific tariffs. Asian countries, particularly Vietnam, have been under significant pressure due to high US tariffs, with exports to the US making up 30% of GDP. China has redirected trade towards other emerging economies since 2016, while India remains relatively less open economically.

- Indirect impact: The indirect effects of US tariffs are more difficult to estimate. Global supply chains could amplify the impact of tariffs, as rising costs of intermediate goods may lead to increased final product prices, affecting overall demand. Additionally, uncertainties regarding global tariffs and potential retaliatory measures could adversely affect the competitive position of the most impacted firms.

Sentiment towards emerging markets recovering

After the dialing down of the draconian US tariffs announced on “Liberation Day“, sentiment towards emerging markets has been recovering. Spreads between emerging markets’ bonds and safer assets have been narrowing. Emerging market currencies have become less volatile and have shown a stronger performance, while business surveys have improved in some emerging countries.

Several factors contribute to this positive sentiment:

- Supported by fiscal spending, domestic demand in emerging markets is contributing to the resilience. Consumption and investment growth in India, Brazil and China have been holding up well.

- Some low-income countries are somewhat isolated from recent developments because of their weak trade and financial linkages with the US. Additionally, emerging markets’ exports have been boosted by the front-loading of exports to the US, ahead of tariff announcements.

- Central banks have been able to reduce exchange rate pressures through foreign currency interventions, but these are only temporary measures and cannot be used indefinitely, given the finite level of international reserves used to defend their currencies.

- A weaker US dollar is making it less burdensome for emerging markets to service their dollar-denominated debt.

- Countries, including the EU, the UK and China, are rethinking their supply chains by trying to broaden their trade links.

Adapting to a new world order

The path that the US administration has chosen for the rebalancing of its economy has short-term costs for emerging markets that appear to be manageable at the current tariff levels, assuming that the related uncertainty fades away in time. The longer this uncertainty lasts, however, the higher the costs, mostly related to the deterioration of the business environment, leading to delayed investments, fewer jobs and lower GDP growth. Undoubtedly, countries are not standing still and will adapt and search for new opportunities. Countries with sufficient fiscal space will be able to do more, others will need to continue reducing their fiscal and current account deficits while building up international reserves. For these countries, private financing is not just an option, but an indispensable catalyst for development in a new world order. Acting promptly will reduce debt distress and be beneficial to all.