Financing change

Let’s start our reflections on a year of impact with inspiring additions to our investment portfolios. These are the companies, entrepreneurs and institutions working on solutions to the world’s most critical sustainability challenges. Each was selected by us for the role they play in accelerating the five transitions that we see as vital in a green, resilient and inclusive economy: Food, Resource, Energy, Societal and Wellbeing.

First, we highlight some of the new investments made by our Impact Private Debt and Equity funds in 2023.

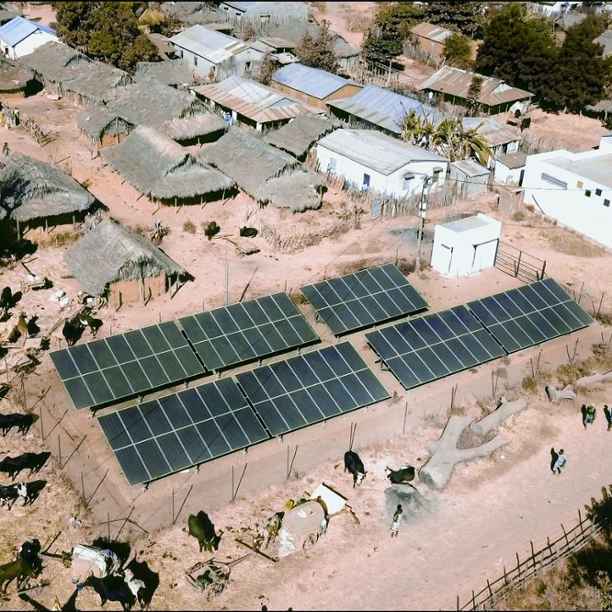

- WeLight in Madagascar and German-based Sunvigo are inspiring examples of companies that contribute to shifting from fossil-based energy systems to clean energy that is accessible and affordable for everyone. WeLight’s solar mini-grids provide 45,000 households and businesses with first-time access to energy. The project also benefits schools, health centres and public spaces. With its smart solar-as-a-service product, Sunvigo maximises the value of residential solar power systems and democratises access to solar power for homeowners.

- We added Berlin-based KoRo to the Triodos Food Transition Europe Fund portfolio. The investment supports this food company to become Europe’s leading brand for high-quality food with a focus on transparency and fair prices.

- Empowering individuals and businesses by integrating them into the financial system is essential for their resilience, especially in emerging and developing economies. Two additions to our financial inclusion portfolio showcase our commitment to this. UsPlus in South Africa is a high-impact fintech company that provides working capital solutions to the SME sector. As one of the few financial institutions in Colombia, UNI2 Microcredito operates in post-conflict areas where poverty rates are high.

Let’s also have a look at some striking examples of the broad impact that our Impact Equities and Bond strategy achieves.

- Planet Fitness offers affordable gym memberships in under-served communities. By doing so, this company helps to mitigate the negative health effects associated with poverty and lack of access to fitness facilities.

- US company Xylem offers products and services that improve water quality and reduce the environmental impact of human activities. It uses smart technology to clean waste water for responsible discharge back to nature.

- We included the debut Saxony-Anhalt social bond to our Euro Bond Impact portfolio. Saxony-Anhalt is one of the smaller German states and will use the proceeds of the bond to finance and promote social sustainability, including affordable basic infrastructure and employment generation.

- Swedish Orphan Biovitrium is new in the Future Generations portfolio. This biopharmaceutical company focuses on rare diseases. There are around 6,000 distinct rare diseases affecting more than 300 million people. Around 75% of these diseases affect children, having a devastating effect on their life expectancy and quality of life.

Company engagement as a force for change

Just like energy, money sets things in motion. That’s what we see when we invest in companies, entrepreneurs and institutions that are driving the vital transitions we want to see. But we are more than a capital provider.

We have one-on-one conversations with companies to discuss sustainability topics that are important to us as an investor. This dialogue is a vital part of our selection and investment process.

Our approach involves ad hoc engagement activities and a formal engagement agenda. During 2023, we engaged on several topics as part of our Impact Equities and Bond strategy:

- Family-friendly working places

Family-friendly work policies play an important role in improving children's wellbeing. We started an engagement project to support UNICEF and align with the mission of our Future Generations strategy. It covered topics such as parental leave, flexible working hours, breastfeeding support at work, childcare support, living wages and job security. - Plastic pollution

The current rate of plastic production is unsustainable, and cleaning up the aftermath is an overwhelming task. Companies in the consumer staples sector are some of the biggest plastic users when it comes to packaging. We engaged on this topic with 12 companies. - Hazardous chemicals

In 2021, we joined a collaborative engagement to encourage chemical companies to phase out hazardous chemicals and transition towards more sustainable solutions. In 2023, we completed our second round of engagement with chemical companies Evonik and Shin-Etsu. This round focused on synthetic, highly toxic PFAS - a topic that regularly hits the headlines.

During 2023, we also continued our climate change engagement project, encouraging our portfolio companies to set science-based targets, aligned with the Science Based Targets initiative. We also engaged with companies on excessive executive remuneration.

Changing finance

As an investor we believe it’s important to speak up. We share our knowledge and expertise on sustainable finance with policymakers in meetings or through feedback in public consultations. A good example is our position on what’s next for the Sustainable Finance Disclosure Regulation (SFDR). We see this regulation as instrumental in directing billions of euros into sustainable investing.

To improve the SFDR, we proposed a new investment categorisation system in 2023, as part of a consultation round initiated by the European Union. This categorisation system is simple, clear and will enable investors to make informed decisions about the sustainability efforts of a financial product. Visit the dedicated SFDR and EU Taxonomy page for the latest news and insights.

Taking steps with our impact management approach

Our impact measurement and management approach is holistic. It is designed to encompass both positive and negative impact and sustainability risks. And we are continuously adapting our processes in the context of evolving regulation, and also to underpin our impact goals.

The increasing EU regulation on sustainability, such as the SFDR and EU Taxonomy, dictated a great part of our impact management and measurement work during 2023. For example, in addition to measuring positive impact, the regulation also required us to measure and report quantitatively on the adverse impact of our portfolios for the first time. For private investments, this meant asking our investees to start collecting and reporting on new information, such as their total energy use and gender pay gap.

We have improved the impact framework for each of our funds, including enhanced ESG assessment for our Impact Equities and Bond funds. Improved data quality allows us to refine our selection process and to better align our transition themes – Food, Resource, Energy, Societal and Wellbeing - with the UN Sustainability Development Goals.

We strongly believe that collaboration is key in bringing impact management and measurement to the next level. In our Financial Inclusion portfolio, we deepened our partnership with Cerise+SPTF by incorporating their common framework for measuring impact performance and implementing the Universal Standards for Social and Environmental Performance Management.

We also supported the 60 Decibels Microfinance Index, a groundbreaking initiative that provides high-quality, comparable impact data for the microfinance industry, driven entirely by the voice of microfinance clients.

We became a member of 2xGlobal, a global network focused on gender-smart investments. This is an important step in developing our gender lens investment approach in 2024.

Looking ahead

Impact investing plays a crucial role in navigating a world at a crossroads. Our investment choices shape both the economy and society, so we will remain committed to using money as a force for good and continue our journey to invest in a thriving planet for all.