Positive data should therefore not be interpreted as being proof that a swift full-blown economic recovery is underway. More importantly, we expect the economic recession to increase inequality, both on corporate and household level. If fiscal policies fail to adequately address this undesirable development, the most vulnerable in society will bear the brunt. Fiscal measures should therefore encompass sustainability in its widest sense, so that the recovery will not only be green, but also inclusive.

Fiscal policies should target an inclusive recovery

Read the full Developed Markets Outlook.

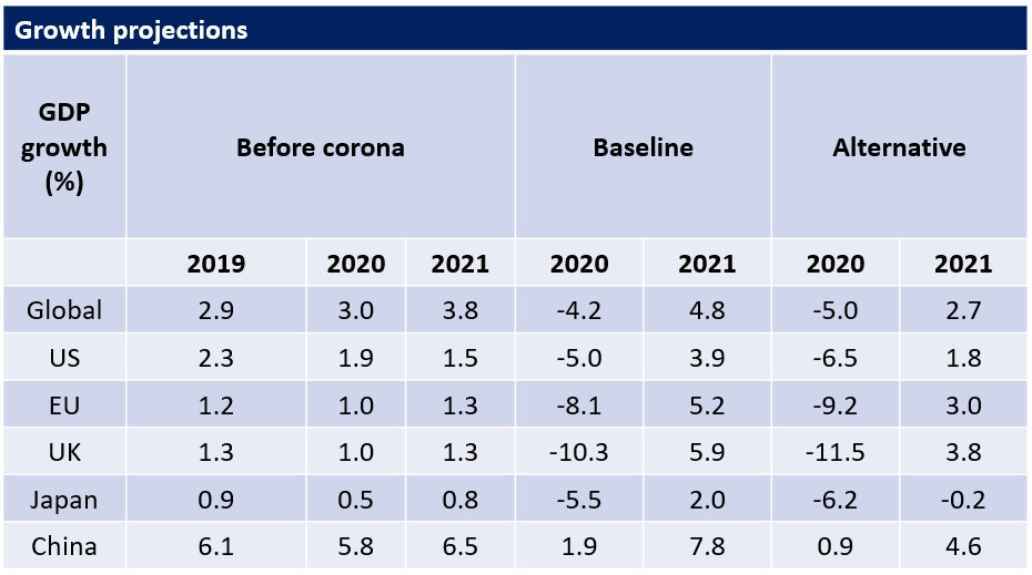

We have made an upward revision to our growth projections, as recent macroeconomic data indicated that the pickup in economic activity materialised earlier than we had anticipated. This still means, however, that the world will experience the largest economic contraction in peacetime. In our base scenario, assuming recurring localised lockdowns for the remainder of the year, we expect an annual economic growth rate of -4.2% in 2020 and 4.8% in 2021.

We foresee that the growing discrepancy between financial markets and the real economy will ultimately lead to some form of reality check, although the current situation may well continue for quite some time. Based on our fundamental approach, we maintain our cautious stance and remain underweight in equities and neutral in bonds.

Below the surface, inequality looms

Besides the ongoing upward trend in financial markets, economic data has also shown substantial improvement in economic activity more recently. This should, however, not be interpreted as a sign of a swift, full-blown economic recovery, as explained in our previous outlook. Furthermore, the headline numbers mask the increase in inequality, with the most vulnerable in society being disproportionately impacted by the COVID-induced economic recession. This delays progress towards the Sustainable Development Goals by a decade and leads to further polarisation between and within countries, thereby negatively affecting political stability, civil rights and violence. It shows why the world needs a more resilient economic system.

Signs of a COVID-induced increase in inequality are visible both at the corporate and the household level. In the corporate sector, the implemented monetary policies have created a discrepancy between the borrowing costs for mid-sized and smaller companies and a few large, listed companies. For households, the COVID-induced shutdown of certain sectors mostly affected low-income households, and permanent job losses are also most likely to materialise within these sectors.

Fiscal choices determine economic prospects of most vulnerable

The focus on direct cash payments will likely lead to less severe economic contractions in 2020 in the US and Japan. The UK and the eurozone, on the other hand, have focused more on furlough schemes and are therefore better positioned to bounce back in 2021. For the UK, however, uncertainty about Brexit trade negotiations and an unfavourable sectoral composition darken the economic outlook. Looking forward, it is vital that all regions make sure the economic recovery is an inclusive one, since even the eurozone is likely to experience an increase in inequality, with all the adverse effects described earlier in the longer term. Therefore, a reset of the economic system should not only mean greening it, but should also entail making it more inclusive. This should be done through fiscal policies that force a wealth redistribution within society through (more) progressive taxation of wealth and income and putting a fair price on unsustainable practices. This way, governments can make sure that the COVID-19-induced recession does not lead to an increase in inequality.