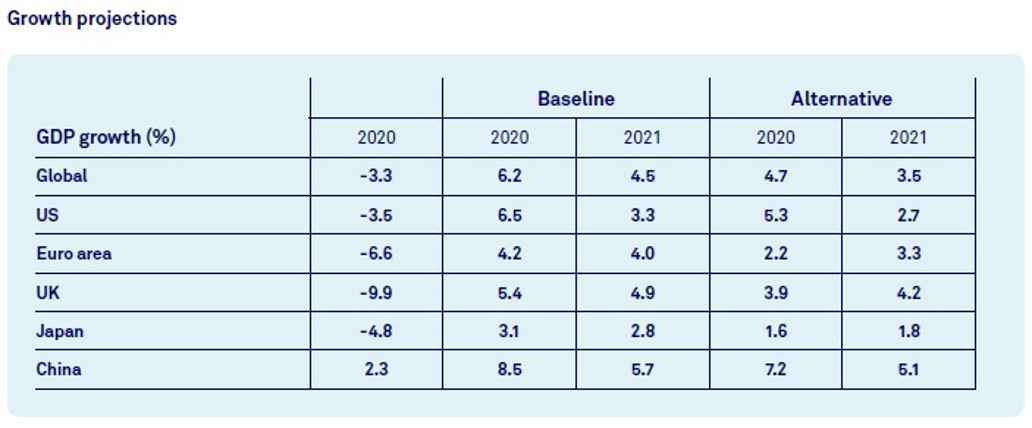

The good news is that the recovery of advanced economies is gaining speed. We have made an upward revision to our growth projections, as the pick-up in economic activity materialised earlier than we anticipated, and the total amount of implemented global fiscal stimulus has exceeded our expectations. In the course of summer, we expect restrictions in advanced economies to be substantially eased, making way for a strong global economic recovery on the back of excess household savings and pent-up demand.

Building back without foresight

US to drive the global recovery, eurozone clear laggard

Near-term recovery prospects across advanced economies vary greatly, because of three root causes: The eurozone and the UK have opted for very stringent lockdown measures, while the US chose to be more flexible and Japan has had less need for stringent measures; the US has outsized most of its counterparts with respect to the extent of the fiscal support in both 2020 and 2021; and the UK and the US have so far been much faster with the vaccine rollouts than the eurozone and Japan.

Taking all this into account, the US seems well positioned to reach pre-pandemic levels of economic activity before the second half 2021. It will therefore be the main driver of the global economic recovery. Japan will reach pre-pandemic levels in the second half of 2021, while both the eurozone and the UK are unlikely to reach pre-pandemic activity levels before the second quarter of 2022. Between the UK and the eurozone, we expect that the UK’s pace of recovery in the next few months will likely be stronger due to its more successful vaccination campaign.

No sight of green and inclusive recovery yet

Although the near-term global economic outlook seems bright, the lack of focus on the longer-term recovery has so far led to policy measures that merely target a bounce-back to the old economy. Measures that steer towards a green and inclusive recovery have been almost non-existent. The coming months will be crucial in determining the direction of the upcoming recovery. In order to achieve a sustainable, inclusive and climate-resilient recovery pathway, governments should focus on early CO2 mitigation and the achievement of the world’s Sustainable Development Goals (SDGs), instead of focusing on old-fashioned metrics like GDP growth.

Allocation: cautious stance

Based on our fundamental approach, we maintain our cautious asset allocation stance and remain underweight in equities and neutral in bonds. We do not think that the current valuations properly reflect underlying fundamentals and assume central banks can’t keep financial assets inflated forever. We prefer high-quality names as the negative effects of the collapse in economic activity are likely to materialise at a later stage once emergency support is being lifted.