Positive surprises

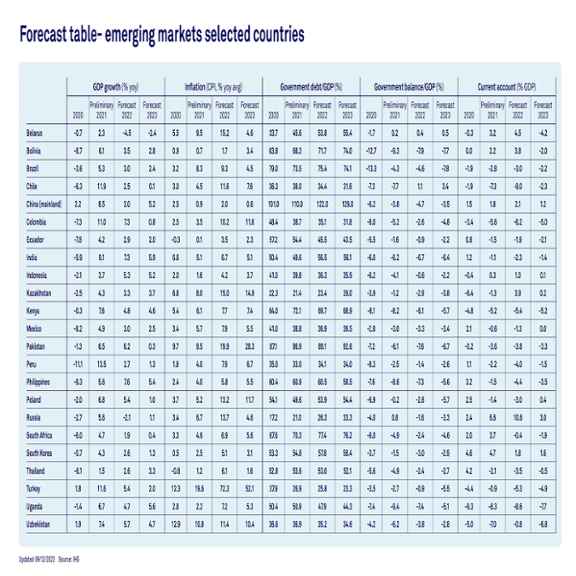

In line with the better-than-expected economic performance in advanced economies this year, emerging markets, in general, have seen their growth forecasts being revised upwards.

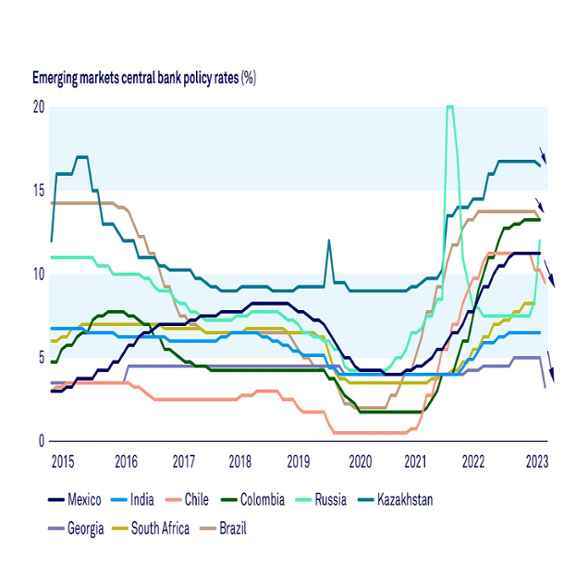

Also, the fastest tightening cycle in decades proved manageable for many emerging markets. It helped that emerging markets monetary authorities, before rate hikes started in the US, undertook timely proactive rate increases and accumulated higher stocks of international reserves. The major central banks are still on the cautious side in their communication, however. They have the complicated task of balancing the risk of tightening monetary policy too much and hurting their economies unnecessarily against the risk of tightening too little and being unable to meet their inflation targets. We expect the Fed to have ended its rate hike cycle and we have pencilled in one additional rate hike for the ECB. As the end of interest rate hikes in the US and eurozone appear to be nearing and inflation pressures subsiding, a few emerging market central banks even cut their rates, including Chile, Brazil, Georgia and Kazakhstan.

And finally, there is improved confidence in low-income countries engaging in new IMF programmes.

Emerging markets generally coping well

Emerging Asia and emerging Europe have been the growth vanguard over the past quarters. India, one of the best performing economies this year, reported GDP growth of 7.8% in the second quarter, showing robust investment growth in infrastructure, a healthier financial system, which is driving credit growth, and strong services exports.In some countries in emerging Europe, including Kazakhstan and Georgia, remittances and double-digit trade growth have been supporting economic activity.

Latin America and Africa are slowing down compared to last year, even if the major economies in these regions showed positive growth surprises. Many emerging markets have accessed financing from multilaterals and/or China and where local financial markets are deeper, active local (resident) investors have proven to be a good alternative for foreign funding.

Headline inflation in emerging markets continued falling and core inflation has been moving down steadily towards central bank targets, with only a few exceptions including Ghana, Pakistan, Turkey and several Eastern European countries. There are some threats to the inflation outlook though. El Niño could bring more extreme weather affecting agriculture and fisheries and raising food prices. India has already banned the exports of rice to mitigate the impact of the monsoon on domestic prices, leading to rising international rice prices. Climate change is also affecting the normal flow of international shipments and increasing shipping costs. The current drought is impacting the Panama Canal, limiting both the number of ships that can pass as well as the maximal load per ship. Around 29% of global container crossing travels through this canal and food and drinks make up approximately 77% of these container shipments.

China’s outlook a bit more cloudy

China’s economy has been hit by headwinds. Property market developments have increased the financial risks and have hurt consumer and business confidence. The strategic competition between China and the US, which is ongoing, is not helping. Relations have become more complex than simply trade as they bring in security concerns on technology transfers.

But China’s authorities appear not too concerned about near-term developments. They are fine-tuning their policies in response to the recent disappointing economic activity data. Interest rate cuts, focused support for the country’s residential property market, including lower rates on existing mortgages, and reductions in down payment requirements for homebuyers are only some of the recent measures. And the central government has fiscal space to do more: transfer cash to households and boost consumption, to get the economy moving again. China has forecasted GDP growth of 5% in 2023, which is in line with our view.

IMF support lifting the weaker economies, but no long-term shifts

Countries that were able to reach an agreement with the IMF, such as Sri Lanka, Pakistan, Ghana and Kenya, benefited from positive investor sentiment over the past few months. These recently approved IMF programmes provide a crucial source of bridge financing in the near-term and serve as trigger for governments and donors to renew their financial relations with countries committed to meeting the IMF requirements. Supported by the IMF, these countries are bringing international reserves to more acceptable levels. However, these programmes are not an easy fix, as they require difficult sacrifices.

The problem is that it is difficult to reshape an economy when in these countries (Sri Lanka and Pakistan), around a third of fiscal revenues is spent on interest payments on debt, leaving little room for significant fiscal consolidation. And precisely these low-income countries lack the means to reconcile climate adaptation and mitigation with social-economic development. Recently, African leaders have been calling for a global carbon tax on fossil fuels so that the largest emitters contribute to increase climate-related investment in the poorer countries. Additionally, the G-20, backed strongly by the US, are summoning the World Bank to play a much larger role than now in delivering concessional financing in the most effective way. More structural use of multilateral and development lending would help to attract private investors by making borrowing less risky and more affordable. There are many initiatives being discussed for some time now, but it’s time to put words into action and end the negative spirals.

Emerging markets' challenges and opportunities going forward

Despite the resilience that many emerging economies are showing after several shocks and the high interest rates in advanced economies, challenges persist. We expect the pace of slowdown to increase in advanced economies in the coming quarters, having some negative spill-over effects on global growth. At the same time, the fate of many emerging markets will rest to some extent on China’s ability to muddle through the current environment. China is not only an important trading partner, but it is also a large lender to emerging markets, particularly to those countries having limited access to the global capital markets, including Bolivia, Ecuador, Pakistan and Sri Lanka. And as mentioned, better international coordination and more concessional financing compared to what they receive now is required to help low-income countries manage their high debt levels and the steadily growing climate risks.

At the same time, the opportunities are plenty. Emerging economies with vast natural resources, including in Africa and South America, using their revenues wisely to reduce the obstacles to development have an enormous potential. There is also a lot of optimism about the larger economies, including India, where capital spending is increasing, bringing opportunities to road, rail and renewable infrastructure. And even hard-hit Turkey, with its new economic plan, is back on the radar of investors. But investments in low-income countries must also increase, as the need for human capital, improved wellbeing, but also an energy transition is as strong there as elsewhere. Private investors looking to balance financial and social returns should not miss this opportunity.